We will endeavor to expand our business

through aggressive investment

while maintaining a strong financial base

Review of business performance in fiscal 2022

Toshiya Hirai

Director, Managing Executive Officer

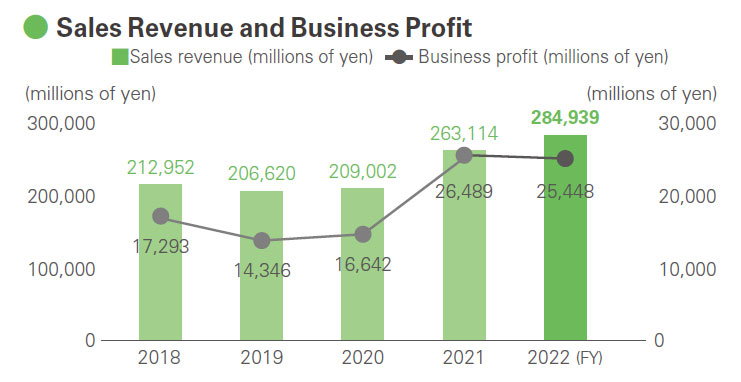

Although the sales volume of our products decreased in fiscal 2022, we achieved a record high in sales revenue. The decline in sales volume can be attributed to a decline in demand for consumer devices such as smartphones and computers due to lockdowns in China because of COVID-19 infections, and the easing of stay-at-home demand elsewhere. It can also be attributed to a deterioration of the business environment, including a delay in the recovery of automobile production due to the semiconductor shortage and the situation in Ukraine. On the other hand, the depreciation of the yen and reflection of increases in the cost of energy and raw materials in final sales prices led to an increase in sales revenue.

Business profit decreased compared to the previous year, due to a decrease in the volume of semiconductor materials and high performance plastics, and the effects of increased personnel costs stemming from labor shortages. However, we were able to keep the decline in profits to a minimum thanks in part to steady performance of our quality of life products.

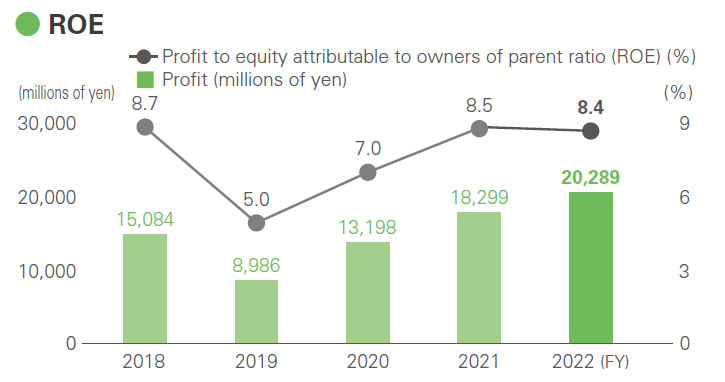

Profit attributable to owners of the parent company increased for the third consecutive year, reaching a record high of 20.3 billion yen, thanks to factors such as increased interest income from affiliates. I believe that the reason why our Group has been able to make a profit in the midst of drastic changes in the business environment is our agile worldwide implementation of measures tailored to the state of affairs.

| Sales revenue | ¥284.9 billion |

|---|---|

| Business profit | ¥25.4 billion |

| Operating income | ¥24.8 billion |

| Profit attributable to owners of parent | ¥20.3 billion |

| ROE | 8.4% |

Progress of Medium-Term Business Plan

We were able to achieve our initial performance targets for the Medium-term Business Plan that started in fiscal 2021 in the very first year. Therefore, we set new targets in fiscal 2022 to reach 300 billion yen in sales revenue and 30 billion yen in business profits. To reach our goal of "achieving top share in niche markets in the functional chemical sector, in accordance with the SDGs, while expanding the scale of business," we have focused on trying new business models, evolving our organizational culture, promoting digital transformation, and contributing toward reaching the SDGs. As a result, we have formulated a plan to achieve record-high sales revenue, business profit, and current profit for fiscal 2023.

It is becoming increasingly important to disclose sustainability information to guide corporate conduct. We established the Sustainability Promotion Department in April 2023 to organize and systematize our departmental policies. We will continue striving to reach carbon neutrality on a global scale by expanding our use of electricity from renewable energy sources, installing more solar power systems, and considering new technologies.

From the perspective of securing human resources, which we expect to become more difficult, we will strive to respect diversity, improve the value of human capital, and increase labor productivity by investing in the digital transformation required to achieve this.

Outlook for business performance in fiscal 2023

Our consolidated results for fiscal 2023 are expected to reach sales revenue of 295 billion yen, business profits of 28.5 billion yen, and current profits of 21.5 billion yen. As for this fiscal year, although demand has continued to slow for the second half of fiscal 2022, the market is expected to gradually recover. Since we expect that it will still be difficult to secure sales revenue at the beginning of the fiscal year, we will work to secure profits through meticulous cost management, while also setting up a production system that will ensure that we do not lag behind the recovery in demand.

I also feel that, more than ever before, we need to work on developing new products and new applications, and quickly acquire new customers.

Basic Policy for financial strategy

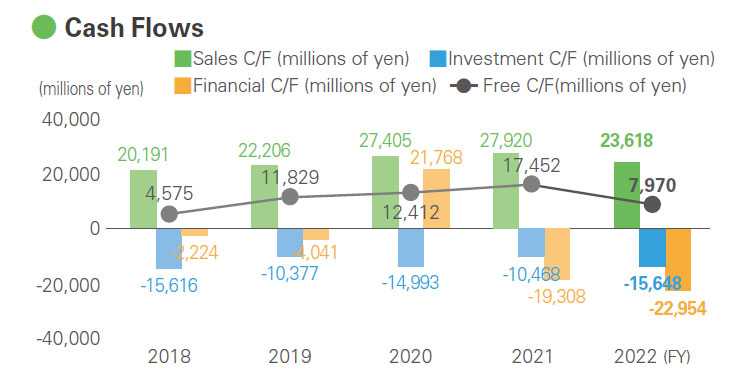

I believe that the most important thing is to maintain a firm financial foundation, and to conduct our business based on the premise of stable fund management. In addition to requiring long development periods, our Group's functional chemical products are used in fields such as the automotive and electrical and mechanical industries, where extremely high reliability, safety, and long-term stability are required. Under these circumstances, we believe that maintaining a firm financial foundation is a source of reassurance for our customers, and that building long-term partnerships with our customers is essential from a strategic point of view.

At the same time, for our Group to expand, we need to actively invest in the future. We want to take a proactive approach to investments, business expansion, and mergers and acquisitions aimed at promoting sustainability mentioned earlier, and make sure to get the timing right. We will further increase our profitability by aiming for an ROE of 10%, as set out in our Medium-term Business Plan.

A message to all of our shareholders and investors

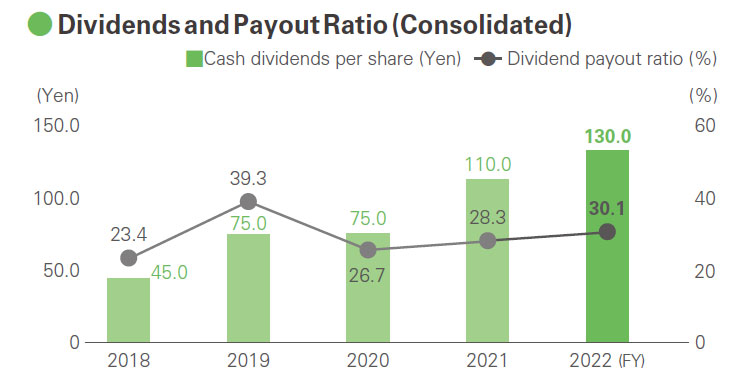

Regarding shareholder returns, our existing policy of effecting stable continual shareholder returns has not changed. Specifically, we would like to continue to maintain a rough target of 30% or more for our dividend payout ratio. In fiscal 2022, thanks to improved business performance, we were able to pay an interim dividend of 60 yen per share and a year-end dividend of 70 yen per share, for an annual cash dividend of 130 yen per share, an increase of 20 yen per share over the annual cash dividend paid in fiscal 2021. We foresee even greater improvement in business performance in fiscal 2023, and on April 24, 2023, announced that we expect to increase dividends by 10 yen per share, for an annual cash dividend of 140 yen per share.

In addition to increasing dividends for the third year in a row, we also conducted a share buyback in May 2023 with the aim of provide shareholder returns. Meanwhile, we intend to actively pursue mergers and acquisitions that will help to enhance the corporate value of our group. I would like for you to understand that mergers and acquisitions are measures we hope will return the fruits of business expansion and strategic investments made from a medium- to long-term perspective to our shareholders and investors.

We will respond to the various changes in the business environment with agility and flexibility, and continue to create products and services that are indispensable to society, as we aim to exceed the expectations of all stakeholders and become "a company that makes your dreams for the future a reality." I hope that you will continue to honor us with your support.

Topics More

- 2024/02/01 Sustainability Sumitomo Bakelite Co., Ltd. announces its establishment of “Human Rights Policy for the Group of Sumitomo Bakelite Co., Ltd.”

- 2023/10/31 Sustainability Integrated Report 2023 of Sumitomo Bakelite Co., Ltd. has been issued.

- 2023/06/21 Sustainability Selected as an iSTOXX® MUTB Japan Platinum Carrier 150 Index

- 2022/10/31 Sustainability Integrated Report 2022 of Sumitomo Bakelite Co., Ltd. has been issued.

- 2022/10/14 Sustainability Sumitomo Bakelite Co., Ltd. Receives Gold Medal in EcoVadis Sustainability Assessment

- 2022/05/27 Sustainability Participation in the 30by30 Alliance for Biodiversity

Inquiry

Inquiry