Support initiative for TCFD recommendations

February 2021, the Group announced its agreement with the TCFD recommendations. In addition to switching to electricity from renewable energy sources and increasing the sales ratio of products that contribute to the SDGs, we formed a company-wide cross-organizational task team and began full-scale efforts to disclose information based on the TCFD recommendations.

Governance

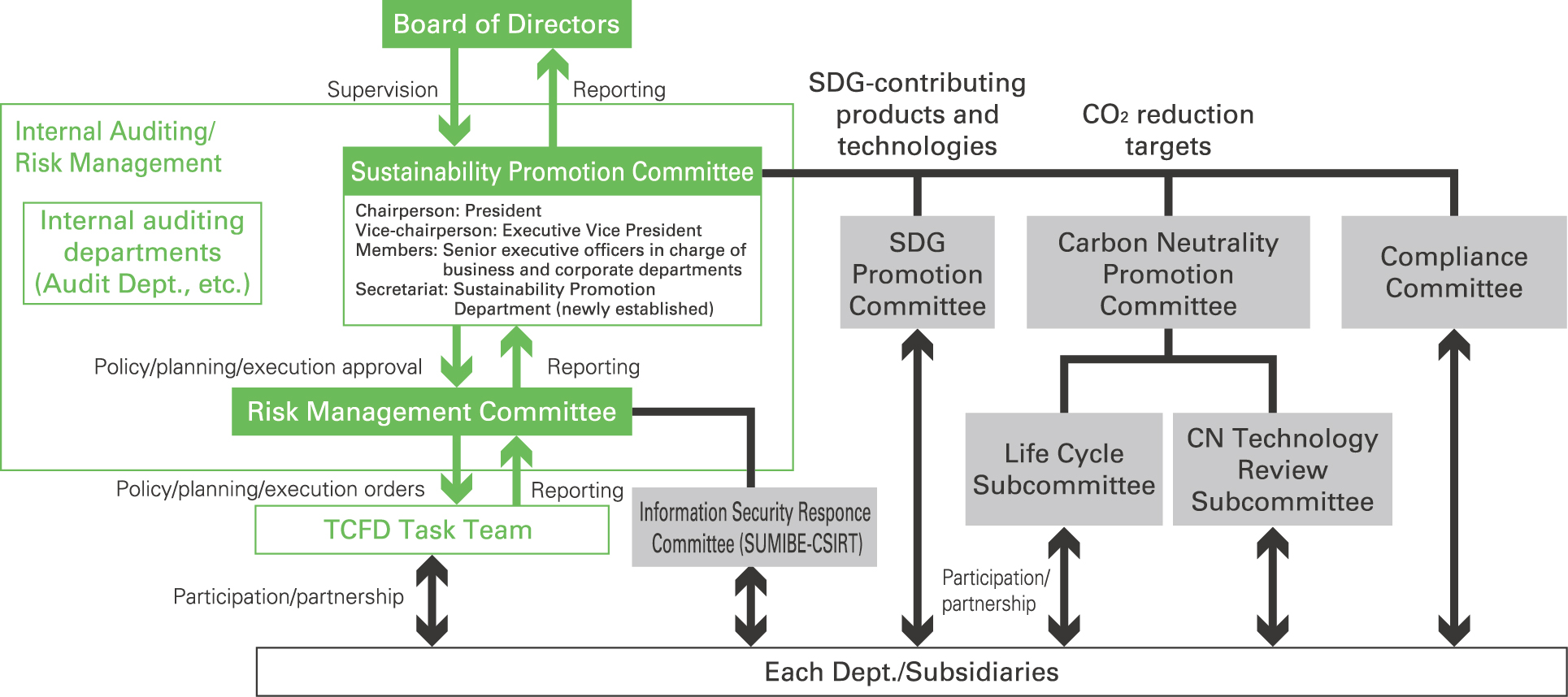

A TCFD Task Team was established under the Risk Management Committee under the Sustainability Promotion Committee for ongoing TCFD (information disclosure) and more comprehensive disclosure details. See the "Sustainability Promotion System" for details of governance related to the "TCFD Task Team."

Strategy (impact on the organization's business, strategy, and finances)

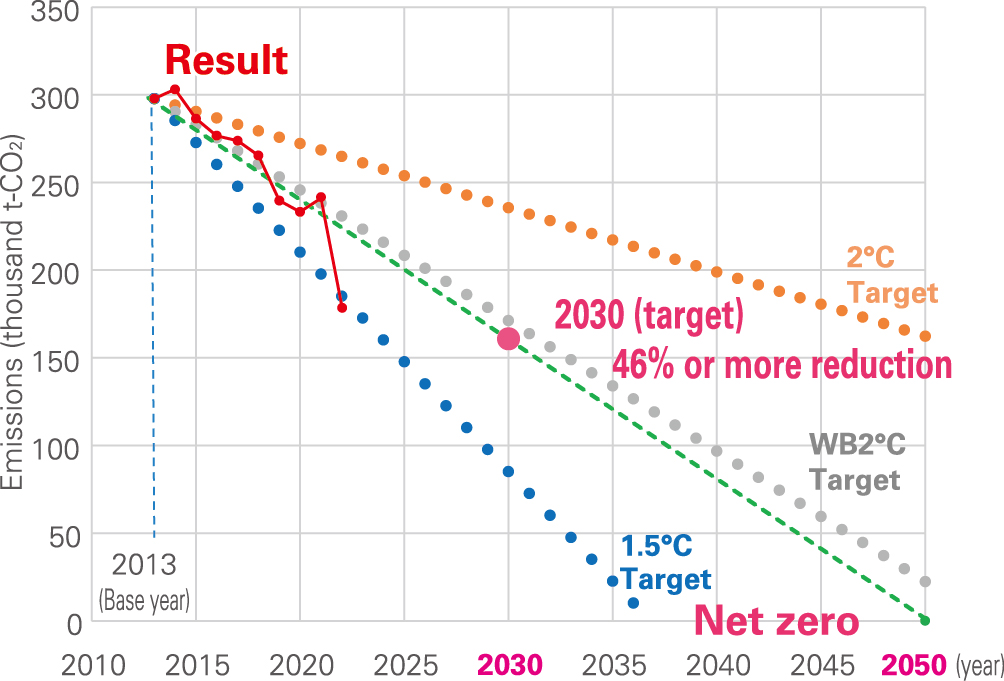

As part of its efforts to address and strengthen its response to climate change, the Group has established Environmental Vision for 2050 (net zero), with the goal of reducing CO2 emissions by 46% or more (compared to fiscal 2013) by 2030, and the 2050 target of taking on the carbon neutrality challenge. We have introduced electricity derived from renewable energy sources to all of our domestic establishments from January 2022. The introduction of energy conservation activities, solar power generation, electricity derived from renewable energy sources, and other efforts resulted in a 40% reduction in CO2 emissions (compared with fiscal 2013) in fiscal 2022.

With regard to TCFD, in fiscal 2021 the TCFD Task Team also led a climate-related scenario analysis project for the year 2040 (long term), identifying potential risks and opportunities associated with climate change. We have identified the following risks and opportunities that we expect will have a relatively large financial impact.

In fiscal 2022, we updated information about "plausible scenario components" of the "climate-related scenario analysis," and verified that there were no changes to "our Group impact assessment."

The 1.5/2℃ scenario

[Risks]

[Opportunities]

| Drivers | Plausible scenario components (world developments) |

Our Group impact Impact assessment | Risks Opportunities |

|

|---|---|---|---|---|

| Policies & regulations | Carbon price increase | ● Carbon price rise [Carbon prices under the 1.5℃ scenario (advanced industrial nations)] 2030: 140USD/t-CO2 2040: 205USD/t-CO2 2050: 250USD/t-CO2 (2022 IEA World Energy Outlook) |

● Increase in operating costs due to higher manufacturing energy costs |

Risks |

● Transport cost increase |

Risks | |||

| Market | Low-carbon technology progress | ● Higher electricity prices due to greater demand for electricity from renewable energy sources |

● Operating cost increase |

Risks |

● Rising prices of raw materials due to increasing demand for biomass-derived raw materials |

● Soaring prices of biomass feedstock |

Risks | ||

| Reduced demand for gasoline associated with low-carbon technology progress | ● Naphtha gains status as a main product, rather than its conventional by-product status

● Along with gasoline and diesel, naphtha is in stable supply, but prices are rising |

● Increase in purchase and procurement costs due to higher naphtha prices |

Risks | |

| Digital alternatives to the movement of people and goods | ● Carbon taxes and GHG emission regulations make the movement of people and goods more costly

● Increased demand for semiconductors used in digital devices |

● Sales increase due to sales expansion of semiconductor-related products |

Opportunities | |

| Low-carbon technology progress | ● Resource recycling requirements from customers

● Accelerate switchover to 3R + Renewable (sustainable resource) related products |

● Sales increase due to early market launch of 3R + Renewable products |

Opportunities | |

| Increased demand for low-carbon technology products | ● Shift to a low-carbon society

● Tightening of carbon tax and GHG emission regulations

● Progress in development of CO2 transport technologies sensitive to economic efficiency, and infrastructure buildup |

● Sales increase due to expanded sales of low-carbon products and services |

Opportunities | |

| Increased EV-related demand (battery materials, lightweight automotive materials) | ● EVs steadily increase as a percentage of total vehicle sales volume |

● Sales increase due to expanded sales of products/services for EVs

● Increased sales of lightweight automotive materials |

Opportunities |

-

* Higher operating costs due to carbon price rises:

Assuming our Group's total CO2 emissions for fiscal 2040 is at the same level as fiscal 2022 of approximately 180,000 t/year (Scope 1 + Scope 2) and the carbon price is 27,675 yen/t-CO2 (135 yen/USD), the increase in costs is calculated at approximately 5 billion yen/year.

The 4℃ scenario

[Risk]

[Opportunities]

With regard to diseases and mobility restrictions associated with climate change, we anticipate increased need for home care, including treatment and medication, and increased opportunities for diagnosis at local hospitals and immediate remote diagnosis at home (Point-of-Care Testing, or POCT) for infants and the elderly, who are particularly sensitive to rising atmospheric temperatures. We expect to expand our healthcare business, including various medical devices and diagnostics, and our medical device and pharmaceutical packaging business. By further improving the performance and environmental adaptability of these products, we will contribute to solving social issues on a global scale. The GHG emission reduction targets for 2030 and 2050 will be implemented as a response to the carbon price increase, tighter GHG emission regulations, and changes in fossil fuel prices (these are identified as risks in the 1.5/2℃ or 4℃ scenarios). We will work to accomplish these efforts ahead of time as we convert long-term transition risks into short- and medium-term business opportunities to expand sales.

| Drivers | Plausible scenario components (world developments) |

Our Group impact Impact assessment |

Risks Opportunities |

|

|---|---|---|---|---|

| Market | Fossil fuel price fluctuations | ● Crude oil and natural gas prices rise

Crude oil 2021: 69USD/barrel→2030: 82→2050: 95 Natural gas Japan 2021: 10.2USD/MBtu*→2030: 10.9→→2050: 10.6 Decrease in Japan. Increases in other regions (2022 IEA World Energy Outlook)

|

● Increase in raw materials costs due to higher purchase and procurement costs

● Increase in operating costs due to higher manufacturing energy costs |

Risks |

| Physical risk: Acute | Cyclones, flooding, and other extreme weather events increase in frequency and severity | Intensifying and increasing frequency of cyclones, torrential rains, floods, droughts, etc.

● Major raw material suppliers: operations suspended

● In-house manufacturing sites (domestic and overseas): Operations suspended |

● Reduced sales due to temporary suspension of operations |

Risks |

Resilient urban development promoted → Increased demand for building materials and industrial materials resistant to natural disasters (Examples of required functions: lightweight, highly durable, impact resistant, highly insulating/heat shielding, fire-resistant) |

● Increase in sales of various sheeting products for building materials and waterproof sheeting products and services |

Opportunities | ||

● Decrease in meat livestock → increased demand for packaging materials for long-term preservation of foods and processed products

● Decrease in crop yields → Increased demand for fruits and vegetables packaging materials |

● Increase in sales of various packaging film products |

Opportunities | ||

| Infectious diseases/rising temperatures leading to illness and restrictions on mobility | ● Increased need for diagnosis at local hospitals, homes, remote diagnosis

● Increased healthcare treatment opportunities for young children and the elderly who are sensitive to environmental changes (diagnosis and treatment) → Point-Of-Care Testing (POCT)/increased demand for medical devices

|

● Expanded sales of healthcare products/increase in sales

● Expanded sales of healthcare products/increase in sales |

Opportunities |

Based on the three-year Medium-term Business Plan starting from fiscal 2021, the Sustainability Promotion Committee and Risk Management Committee will also play a central role in fiscal 2023 following on from fiscal 2022 (by backcasting from the results of this scenario analysis) to materialize short-term measures, which are being deployed to relevant internal departments and implemented and promoted with speed. In the medium- to long-term, we will update our scenarios and financial impact estimates as appropriate in light of changes in the macro environment, and work to enhance corporate value through the development of new technologies and products that contribute to a low-carbon society and a recycling-oriented economy. We will also work to enhance the sophistication of our management strategy by reforming our foundational organizational culture and strengthening our human resources.

Risk management

Identification, assessment, and management of TCFD related risks and opportunities is conducted in accordance with our Group risk management processes. See Responding to Business Risks and Opportunities for details.

Metrics and targets

We will respond to the risks identified in the 1.5/2℃ or 4℃ scenarios, such as carbon price increases, stricter GHG emission regulations and fluctuations in fossil fuel prices by proceeding with the GHG emission reduction targets of a 46% or more reduction of CO2 emissions (compared to fiscal 2013) by 2030, and taking on the challenge of carbon neutrality by 2050. (achievements to date are listed in "Taking on the challenge of zero CO2 emissions" on page 49.)

With regard to the development of new technologies and products that contribute to a low-carbon society and a recycling-oriented economy included in these opportunities, the Group decided in fiscal 2018 to incorporate the SDGs as one of its corporate policies and started a certification system for SDG-contributing products, technologies, and activities in fiscal 2019. Contributing to the response to climate change (measures to counter global warming, reduce environmental impact, etc.) is part of the opportunity to achieve the goals of the SDGs, and we hope to contribute to a sustainable society through our business.

Taking on the Challenge of Zero CO2 Emissions

With the aim of providing products and technologies that contribute to the SDGs, the Corporate Planning and R&D departments, among others, examine R&D and sales strategies, then incorporate them into specific goals and plans to manage progress. The Sustainability Promotion Committee has decided on a target ratio of sales revenue from products and technologies contributing to SDGs of 70% or more for fiscal 2030 and 50% or more for fiscal 2023 and is implementing the required activities. The actual results were 48% for fiscal 2021 and 54.5% for fiscal 2022, and the target of 50% for fiscal 2023 was achieved earlier.

Moving forward, we will undertake a series of initiatives that will contribute to the sustainable enhancement of corporate value. We will periodically confirm and update the risks and opportunities identified in our climate-related scenario analysis with an eye to changes in the external environment and market conditions, and will fulfill our responsibility for accountability by disclosing information to stakeholders as appropriate upon quantifying the financial and other impacts, and specifying and enhancing metrics and targets.

Topics More

- 2024/02/01 Sustainability Sumitomo Bakelite Co., Ltd. announces its establishment of “Human Rights Policy for the Group of Sumitomo Bakelite Co., Ltd.”

- 2023/10/31 Sustainability Integrated Report 2023 of Sumitomo Bakelite Co., Ltd. has been issued.

- 2023/06/21 Sustainability Selected as an iSTOXX® MUTB Japan Platinum Carrier 150 Index

- 2022/10/31 Sustainability Integrated Report 2022 of Sumitomo Bakelite Co., Ltd. has been issued.

- 2022/10/14 Sustainability Sumitomo Bakelite Co., Ltd. Receives Gold Medal in EcoVadis Sustainability Assessment

- 2022/05/27 Sustainability Participation in the 30by30 Alliance for Biodiversity

Inquiry

Inquiry