Basic Approach to Corporate Governance

We have set “Toward a sustainable society through expanding the potential of plastics” as the Purpose of our Group with the goal of contributing to value creation for customers and various other stakeholders. For this reason it is important to earn the trust of society and be needed by society, and therefore, we are establishing efficient and effective structures for achieving management that are highly compatible with society and the environment and for addressing risks facing management, including rigorous compliance.

We newly established “Corporate Governance Guidelines of Sumitomo Bakelite Co., Ltd.” as of October 1, 2025. The purpose of these guidelines is to systematically organize and present to our stakeholders the framework and initiatives concerning our corporate governance. For more details, please refer to the guidelines available at the following link.

History of Strengthening of Corporate Governance

| 2002 | Appointed the first 1 Outside Director |

| 2004 | For accelerating managerial decision-making and clarifying management responsibility, introduced Executive Officer structure and reduced the number of Directors (from 17 to 8) |

| 2005 | Shortened term of office of Directors (from 2 years to 1 year) |

| 2015 | Increased the number of Outside Directors (from 1 to 2) |

| 2016 | For structuring an opinion hearing of Independent Outside Directors about nomination and remuneration of Directors, established the Appointment and Remuneration Advisory Committee |

| Increased the number of Outside Directors (from 2 to 3) | |

| Appointed the first 1 female Outside Corporate Auditor | |

| Started analysis and evaluation of effectiveness of the Board of Directors | |

| 2018 | For exchanging information and sharing company view with Outside Officers, established Outside Officers’ Meeting |

| 2021 | Appointed the first 1 female Outside Director |

| Appointed three Independent Outside Directors (1/3 of Directors) | |

| The authority of the Appointment and Remuneration Advisory Committee is strengthened and reorganized into a Nomination and Remuneration Committee with a majority of Independent Outside Directors | |

| 2023 | Introduced system of restricted stock to Officers |

| 2025 | Set performance-linked element for Directors’ bonuses based on KPIs in our Medium-term Business Plan |

| Established Corporate Governance Guidelines of Sumitomo Bakelite Co., Ltd. |

Management System

Board of Directors

We have adopted a company with Corporate Auditors model and have appointed 9 Directors (of which 3 are Outside Directors) and 4 Corporate Auditors (of which 2 are Outside Corporate Auditors) as of June 24, 2025. The Board of Directors is chaired by the Chairman, Representative Director.

At the monthly Board of Directors meetings, Directors make decisions on important matters of business, receive reports on monthly business performance and progress updates from each Director, and listen to the opinions and reports from Corporate Auditors, with the chair of the meeting taking care to ensure sufficient discussion takes place. In the case of conflicts of interest involving any Director, potential conflicts of interest are required to be reported in advance to the Board of Directors to obtain its approval, with reports to be given on the propriety of this after the fact.

Meetings in FY2024

- the Number of meetings held: 13 in total

- Main topics of discussion:

[Resolutions]- Resolutions on matters relating to important business execution, based on laws and regulations, articles of incorporation, and rules and regulations of the Board of Directors

- Formulation of Medium-term Business Plan (2024–2026)

- Revision of policy for determining Directors’ remuneration

- Resolutions on matters relating to capital policy (reduction of strategic shareholdings, share buyback, etc.)

- Reports on business results and overview of each business segment

- Reports on discussions by internal committees (Sustainability Promotion Committee, etc.)

- Matters relating to ESG and sustainability promotion

- Matters relating to risk management

- Matters relating to utilizing human capital

Board of Corporate Auditors

The Board of Corporate Auditors consists of 2 Standing Corporate Auditors and 2 part-time Independent Outside Corporate Auditors. Our policy is to maintain the current diverse composition of individuals with experience and capabilities necessary to perform as auditors, including knowledge of finance, accounting, and legal matters, to provide fair and impartial auditing activities. In addition, under the direction and orders of the Corporate Auditors, 2 members of staff with expertise in internal auditing assist the Board of Corporate Auditors and each Corporate Auditor in their activities. These members of staff serve concurrently in the Internal Audit Department, which deals with internal audits and evaluation of internal controls related to financial reporting based on the Financial Instruments and Exchange Act.

Activities of the Board of Corporate Auditors

- Resolves, discusses, reports, and determines important items related to auditing based on the laws and regulations, articles of incorporation, and rules and regulations of the Board of Corporate Auditors. Meets monthly, prior to the Board of Directors meeting, and also on an ad hoc basis when necessary (In FY2024, the Board of Corporate Auditors met 19 times for an average of 1 hour 19 minutes)

- Reviews audit activities each year and evaluate and verify their effectiveness based on the basic policy of “respond flexibly to changes in the environment and conduct audits in a fair, unbiased, and transparent manner in order to achieve sound and sustainable growth, create medium- to long-term corporate value, and contribute to the establishment of a high-quality corporate governance system that can meet the trust of society”

- Formulated an audit plan for FY2024 including the issues identified as key matters (“confirmation of the status of the Group’s governance and risk management,” “confirmation of the maintenance and operation of the Group’s internal control system,” and “confirmation of the status of the Group’s compliance with laws, articles of incorporation, regulations, etc.”). An overview of this plan was reported at the Board of Directors meeting on June 25, 2024, to promote audit activities

- Standing Corporate Auditors:

- Establish the auditing environment and collect information within the Company

- Receive important drafts, approvals, and management meeting documents

- Participate in the Sustainability Promotion Committee, Risk Management Committee, Compliance Committee, etc.

- Confirm the progress of measures overseen by the committees above and make proactive recommendations to promote measures

- Audit business sites and subsidiaries selected through the risk approach

- Attend accounting audits by the Accounting Auditor and internal audits by the Internal Audit Department

- Outside Corporate Auditors:

- In addition to activities of the Board of Corporate Auditors, participate in Executive Officers’ Meetings, business liaison meetings, budget meetings, etc.

- Participate in audits of business sites and subsidiaries

Major Activities in FY2024

- Exchange opinions with the President and Representative Director (on a quarterly basis, in principle)

-

Share information and exchange opinions with the Accounting Auditor (KPMG AZSA LLC)

throughout the year

- Annual audit plan, risk assessment, important audit areas, key points of audits, progress of auditing work, etc.

- Reports on interim reviews and the Accounting Auditor’s audit reports

- Standing Corporate Auditors attended audit reviews in Japan by the Accounting Auditor and accompanied on-site audits at 7 sites of 6 important subsidiaries in North America and Asia

- Discussed key audit matters with the Accounting Auditor and found no differences of opinion

-

Collaboration with Outside Directors

- All Corporate Auditors attend Outside Officers’ Meetings before the meeting of the Board of Directors to exchange opinions and share information on agenda items and reports to be discussed at the Board of Directors meetings, evaluation of the effectiveness of the Board of Directors, etc.

- As far as possible, conduct on-site inspections of business sites and subsidiaries in Japan with Outside Directors (visited 1 site together in FY2024)

-

Collaboration with internal auditing departments

- Receive reports on internal audit results from General Manager of the Internal Audit Department

- Attend internal audit reviews and audits by the Internal Audit Department

- Exchange opinions at regular meetings with the Internal Audit Department

- Report to the Board of Corporate Auditors by Standing Corporate Auditors

- At least once a year, Outside Corporate Auditors also participate in regular meetings with the Internal Audit Department

Executive Officer Structure/ Executive Officers’ Meeting

We have introduced an Executive Officer structure in which Executive Officers appointed by the Board of Directors as the persons responsible for business execution execute business under the direction of the Company President based on the policies determined by the Board of Directors, and have appointed 18 Executive Officers (including 5 who serve concurrently as Directors) as of June 24, 2025.

Executive Officers’ Meetings are held once a month and attended by Directors, Executive Officers, and Corporate Auditors to convey information on policies and important matters decided by the Board of Directors, to receive reports on business performance and the status of business execution from each Executive Officer, and to review important matters and share information.

With the Executive Officer structure, the resolution of important operations and execution of operations were separated to increase the effectiveness of the Board of Directors in supervising operational execution, increasing the speed of operational execution, and clarifying responsibility. Corporate Auditors oversee the Directors’ execution of their roles and audit the Board of Directors to fulfill its role appropriately. As described above, Directors, Corporate Auditors, and Executive Officers fulfill their respective responsibility and roles to govern the Company in a way shareholders and stakeholders can trust.

As of June 24, 2025, all 26 of our Officers, who are Directors, Corporate Auditors, and Executive Officers, included 22 male and 4 female, with a female board member ratio of around 15%. All of our Officers with the exception of 1 Corporate Auditor are 50 years old or older.

Outside Directors/Outside Corporate Auditors

Outside Director Kazuo Matsuda has considerable experience and wide range of insight that he cultivated at a financial institution as well as business companies as a management executive, and we anticipate that he will bring these abilities to bear in providing germane opinions and valuable advice from an objective standpoint. He also serves as a member of the Nomination and Remuneration Committee.

Outside Director Etsuko Nagashima has an expert viewpoint as a certified public accountant and wide-ranging views related to financial matters and accounting, and we anticipate that she will bring these abilities to bear in providing germane opinions and valuable advice from an objective standpoint. She also serves as a member of the Nomination and Remuneration Committee.

Outside Director Hiroyuki Wakabayashi has considerable experience and a broad insight that he cultivated as a person in charge of manufacturing at a major manufacturer as well as a management executive in charge of technology in general and IT digital, and we anticipate that he will bring these abilities to bear in providing germane opinions and valuable advice from an objective standpoint. He also serves as a member of the Nomination and Remuneration Committee.

Outside Corporate Auditor Kazuhiko Yamagishi utilizes his professional perspective as a lawyer and wide-ranging insight into management for auditing our Company.

Outside Corporate Auditor Noriko Kawate utilizes her professional perspective as a Certified Public Accountant and tax accountant and wide-ranging insight into finance, accounting, and management for auditing our Company.

We have established the Criteria for Independence of Directors and Corporate Auditors through a resolution of the Board of Directors, and has determined that the aforementioned Outside Directors and Outside Corporate Auditors are independent pursuant to said criteria. In addition, we have submitted notification of them as Independent Officers as stipulated by the Tokyo Stock Exchange.

We also hold monthly Outside Officers’ Meetings consisting of Outside Directors, Outside Corporate Auditors, the Director Overseeing the Corporate General Affairs Division and the Corporate Finance & Planning Division, the Executive Officer in charge of the Corporate General Affairs Division, Standing Corporate Auditors, and members of the Corporate General Affairs Division and the Corporate Finance & Planning Division. At the Outside Officers’ Meeting, account settlement overview reports on our Group are shared, introductions to businesses are provided from the Corporate Officers in charge of each segment, and advance explanations of agenda items for meetings of the Board of Directors are provided. This is done in an effort to share information and awareness concerning the Group between Outside Directors and Outside Corporate Auditors.

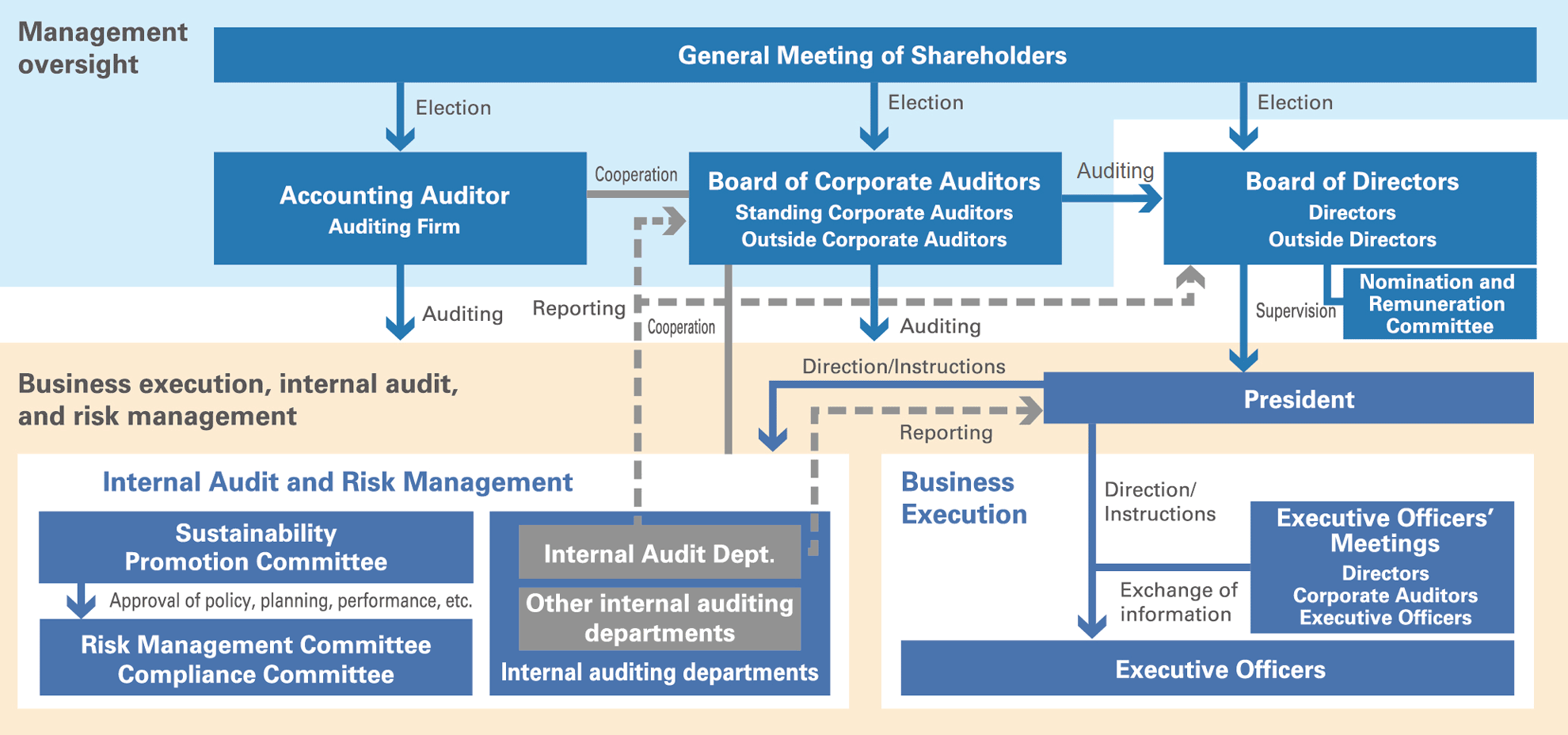

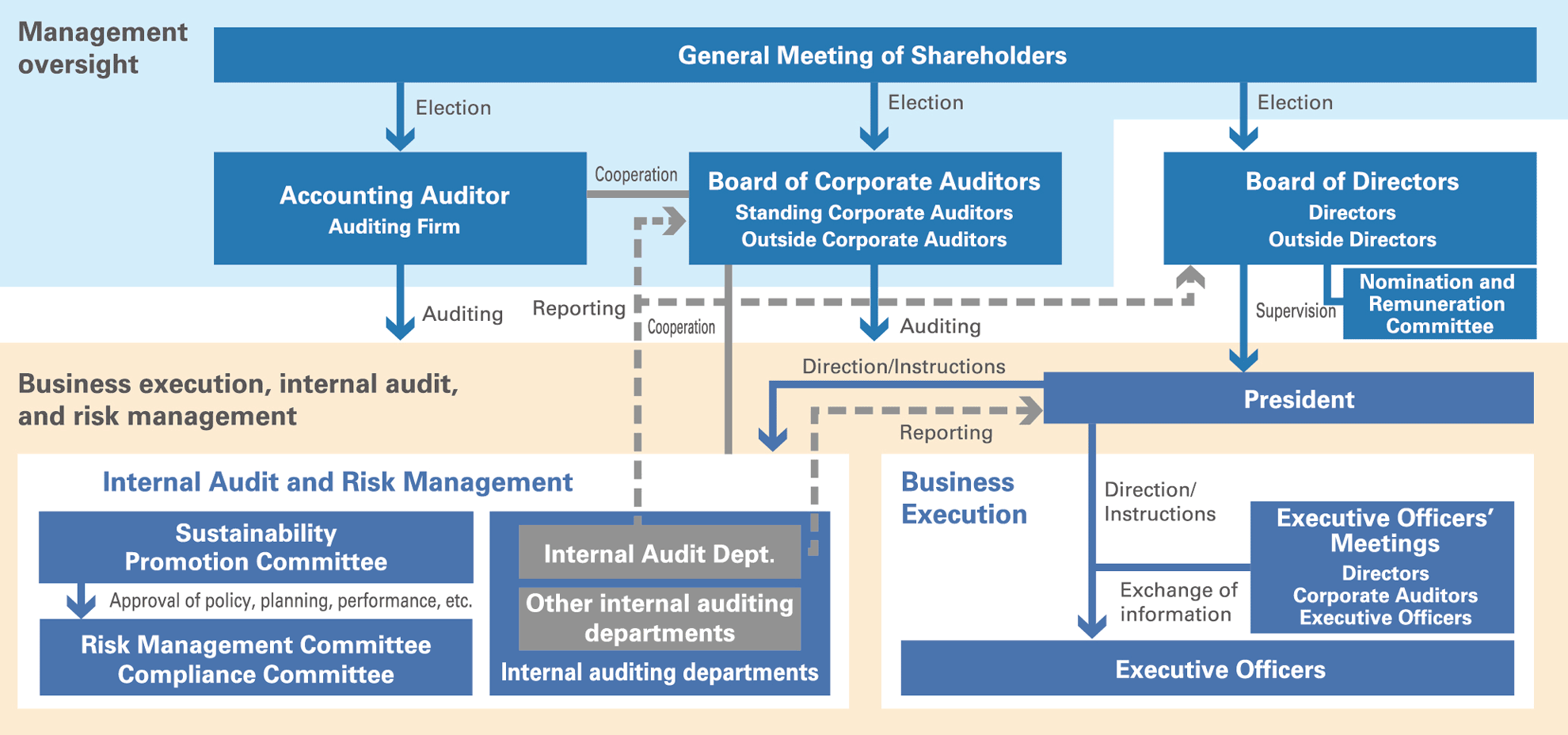

Structure of corporate governance

Nomination and Remuneration Committee

In order to strengthen the independence, objectivity, and accountability of the Board of Directors’ functions concerning the nomination and remuneration, etc. of Directors, the Company has voluntarily established the Nomination and Remuneration Committee consisting of a majority of Independent Outside Directors (Directors submitted as an Independent Officer to the Tokyo Stock Exchange). The Appointment and Remuneration Advisory Committee, which had previously reported to the Board of Directors on matters concerning the nomination of Directors and the determination of remuneration amounts, was granted greater authority and reorganized on June 24, 2021, as the Nomination and Remuneration Committee. As of June 24, 2025, the committee is chaired by Chairman and Representative Director Kazuhiko Fujiwara, with the membership of President and Representative Director Shinichi Kajiya and the Independent Outside Directors (Kazuo Matsuda, Etsuko Nagashima, and Hiroyuki Wakabayashi).

This committee holds deliberations regarding Directorship appointments, including assignments to and dismissals from Directorships, elections and dismissals of Representative Directors, as well as plans for successors of the President and Representative Director. It then reports its findings to the Board of Directors based on the results of these deliberations. The committee is delegated based on findings of the Board of Directors to perform decision-making regarding items (including systems and policy) concerning remuneration for Directors.

In FY2024, in accordance with the above, with regard to the nomination of Directors, the committee appointed candidates for the positions of Chairman and Representative Director and President and Representative Director, selected Director candidates, and held discussions including clarifying the reasons for selection of items in the skills matrix. With regard to the remuneration of Directors, the committee revised the Directors’ bonus system and revised the policy for determining individual Directors’ remuneration accordingly, determined the amounts of Directors’ monthly remuneration, bonuses, and stock compensation by position, and decided the amounts and allocation of individual monthly salary, bonuses, and stock compensation for each Director.

The Committee met a total of five times during FY2024, and all members attended all committee meetings.

Executive Remuneration

To provide an incentive to contribute to the sustained improvement of corporate value of our Group for the medium- to long-term, the remuneration of Directors shall be based on a remuneration system that is linked to management targets and shareholder value. Specifically, remunerations shall comprise “monthly remuneration,” which is a fixed remuneration according to position, “bonuses,” which are performance-linked and based on management indicators set with a view to achieving the long-term visions, and “stock compensation,” which is a form of non-monetary remuneration, as medium- to long-term incentives to encourage the sharing of value with shareholders. However, the remuneration of Outside Directors shall comprise exclusively their monthly remuneration in light of the fact that they supervise management from a position independent of business execution.

By resolution of the Board of Directors, the authority described below to decide on Director remuneration for

FY2024 has been delegated to the Nomination and Remuneration Committee.

• Determine amounts for monthly remuneration, bonus standard amount, and stock compensation by

position

• Determine individual amounts of monthly remuneration and bonuses to be paid and the number of stocks

to be

allocated to each Director

The remuneration of Corporate Auditors consists of basic remuneration (monthly remuneration). The total amount and the amount to be paid to each individual Corporate Auditor are determined in consultation with the Corporate Auditors within the maximum remuneration limit resolved by the General Meeting of Shareholders.

Executive Remuneration in FY2024

| Category of executives | Total remuneration (million yen) |

Total amount by type of remuneration (million yen) | Number of executives receiving remuneration | ||

|---|---|---|---|---|---|

| Monthly remuneration | Bonuses | Stock compensation | |||

| Directors (excluding Outside Directors) | 423 | 225 | 160 | 38 | 7 |

| Corporate Auditors (excluding Outside Corporate Auditors) | 55 | 55 | ― | ― | 2 |

| Outside Officers | 58 | 58 | ― | ― | 6 |

The policy for determining the individual remuneration for Directors is established as follows, by resolution of the Board of Directors meeting on February 28, 2025.

| Composition of executive remuneration | Details |

|---|---|

| Monthly remuneration 50% |

Monthly remuneration is paid in cash as a fixed monthly amount during the term of office. The individual amount is determined by position, taking into consideration the business environment, economic conditions, etc. |

| Bonuses 40% |

Bonuses are based on the achievement of target indicators set out in our Medium-term Business Plan and

material issues with a view to achieving our long-term vision. Specifically, financial and non-financial indicators are set in advance for each fiscal year during the period of the Medium-term Business Plan. The standard amount determined for each position is multiplied by a coefficient indicating to what extent each indicator has been attained. This amount is paid in cash at a certain time after the end of each fiscal year. |

| Stock compensation 10% |

Stock compensation is allocated at a certain time after the Ordinary General Meeting of Shareholders as the number of restricted stocks corresponding to the payment amount determined by position. |

Calculation of Bonuses during the Period of the Medium-term Business Plan 2024–2026

• Indicators Used

| Category | Indicators used | Reason for selection of indicators |

|---|---|---|

| Financial indicators | Business profit | This is one of our management indicators for sustainable growth, which is set as a financial target in the Medium-term Business Plan 2024–2026. |

| ROE | This is one of our indicators measuring management efficiency toward sustainable growth, which is set as a financial target in the Medium-term Business Plan 2024–2026. | |

| Non-financial indicators | GHG emissions reduction (compared to FY2021, applies to Scope 1 and 2 emissions). | This is one of our indicators measuring our efforts to achieve carbon neutrality, working toward the creation of environmental and social values, which is one of our material issues. |

| Latest CDP (climate change) evaluation results | CDP is an international non-governmental organization for disclosure of environmental impact including climate change risks and greenhouse gas emissions. We see this as an objective and impartial assessment of our efforts toward carbon neutrality. | |

| Ratio of female managers (non-consolidated) | This is one of our indicators for promoting diversity in order to put into practice human capital management (utilization of human resources), which is one of our material issues. |

• Degree of Achievement of Target Values and Corresponding Coefficients

| Degree of achievement (%) | 125% or above | Less than 125% but 105% or above | Less than 105% but 95% or above | Less than 95% but 75% or above | Less than 75% |

|---|---|---|---|---|---|

| Coefficient | 1.3 | 1.1 | 1.0 | 0.9 | 0.7 |

| Degree of achievement (%) | Other than CDP evaluation result | 105% or above | Less than 105% but 95% or above | Less than 75% |

|---|---|---|---|---|

| CDP evaluation result | A | A- | B or lower | |

| Coefficient | 1.05 | 1.0 | 0.95 |

• Formula for Calculation of Bonuses

Bonus by position

= standard amount by position × business profit weighting 60% × coefficient corresponding to attainment of

this indicator

+ standard amount by position × ROE weighting 10% × coefficient corresponding to achievement of this

indicator

+ standard amount by position × GHG emissions reduction weighting 10% × coefficient corresponding to

attainment of this indicator

+ standard amount by position × CDP evaluation result weighting 10% × coefficient corresponding to attainment

of this indicator

+ standard amount by position × ratio of female managers weighting 10% × coefficient corresponding to

attainment of this indicator

• Target Indicators, Weights, Target Values, and Results

| Category | Indicators used | Weight | FY2024 target value |

FY2024 result |

Coefficient corresponding to achievement |

|---|---|---|---|---|---|

| Financial indicators | Business profit | 60% | ¥30.0 billion | ¥30.8 billion | 1.0 |

| ROE | 10% | 8% | 6.5% | 0.9 | |

| Non-financial indicators | GHG emissions reduction | 10% | 38% | 45% | 1.3 |

| CDP evaluation result | 10% | A- | A- | 1.0 | |

| Ratio of female managers | 10% | 4% | 4.25% | 1.05 |

Analysis and Evaluation of the Effectiveness of the Board of Directors

We evaluate the effectiveness of the Board of Directors each year. We enhance the effectiveness of the Board of Directors by executing the PDCA cycle of conducting self-evaluations and aggregation of opinions based on a questionnaire survey of all members of the Board of Directors (Directors and Corporate Auditors), holding discussions and exchanges of opinions at meetings based on the analysis results of the survey, summarizing the evaluation results based on these discussions and setting the issues to be addressed, and implementing initiatives to resolve these issues at the Board of Directors.

The results of the analysis and evaluation of the effectiveness of the Board of Directors for FY2024 are summarized below.

1. Evaluation process & evaluation method

| Date | Details |

|---|---|

| Dec. 2024 |

Outside Officers’ Meeting - Progress check of improvements based on the previous fiscal year’s effectiveness evaluation results - Discussion of implementation policy and method for FY2024 effectiveness evaluation - Decision to conduct self-evaluations based on questionnaire survey |

| Jan. 2025 |

Board of Directors - Confirmation of implementation policy and method for FY2024 effectiveness evaluation |

| Feb. 2025 |

Questionnaire survey conducted - Survey subjects: All Directors and Corporate Auditors - Survey contents: Composition of the Board of Directors, operation of the Board of Directors, agenda items, information provision (evaluated on a scale of 1 to 4) To ensure objectivity and transparency, opinions of external lawyers were taken into account when the survey was formulated |

| Apr. 2025 |

Management Committee (Full-time Directors) - Exchange of opinions based on the survey results |

|

Outside Officers’ Meeting - Exchange of opinions based on the survey results |

|

| May 2025 |

Board of Directors - Summary of evaluation results - Identify new issues - Set policy for improvement initiatives |

- Revised some of the criteria for submitting proposals to the Board of Directors in order to enable more agile and flexible resolutions.

- Explained the progress of internal discussions at the Management Committee and the decision-making process for capital investment policies to Outside Officers at the Outside Officers’ Meeting as well as shared the opinions of Outside Officers voiced at the Outside Officers’ Meeting with all Internal Directors to ensure bidirectional information-sharing.

2. Outline of evaluation results and status of initiatives set out last fiscal year

As a result of the survey, we concluded that the operation of the Board of Directors maintains a certain level in both form and substance, and that its overall effectiveness was assured. In addition, regarding the initiative of “clarifying the process for setting the agenda” that was raised in the previous fiscal year, the following initiatives were implemented, and it was evaluated that overall improvements have been made.

Details of initiatives about “clarifying the process for setting the agenda”

3. Newly identified issues and policy for initiatives to address these issues

As described above, we concluded the overall effectiveness of the Board of Directors was ensured, but in order to consolidate the initiatives made thus far, deepen discussions, enhance explanations, as well as further deepen the deliberations of the Board of Directors, we have decided to take the following actions: enhance the content of Board of Directors’ materials, actively present themes that contribute to the medium- to long-term enhancement of corporate value, and further promote bidirectional information-sharing between Internal Directors and Corporate Auditors/Outside Officers.

Internal Control

We have systems in place for ensuring appropriate operations in accordance with our Business Philosophy. In accordance with our Basic Policy on Internal Control System (partially amended by resolution of the Board of Directors meeting held on February 28, 2023 to further promote the system based on the sustainability management and initiatives to strengthen governance) drawn up by the Board of Directors, we periodically review the systems and promote various activities to enhance internal control.

With respect to internal control over financial reporting, based on our Basic Rules and Regulations for Internal Control over Financial Reporting, we endeavor to enhance systems for ensuring the reliability of our financial reporting, appropriately operate internal control systems in terms of implementation, assessment, reporting, and correction, and ensure appropriate and timely disclosure of corporate information. The Comprehensive Guidelines for Internal Control in Consolidated Subsidiaries covers the items that subsidiaries are required to address in establishing their internal control systems and in their subsequent ongoing implementation of control activities.

The internal control over our financial reporting as of March 31, 2025 was assessed and deemed to be effective by internal auditing departments. In addition, as a result of the Accounting Auditor’s audit, it was confirmed that the internal control report presents fairly the result of assessments of internal control over financial reporting.

Directors (as of June 24, 2025)

Directors and Corporate Auditors

Kazuhiko Fujiwara

Chairman of the Board of Directors and Representative Director

- Apr 1980

- Entered the Company

- Jun 2009

- General Manager of S-BIO Business Div.

Executive Officer

- Apr 2013

- Managing Executive Officer

- Jun 2014

- Director

- Apr 2016

- Senior Managing Executive Officer

- Jun 2018

- President and Representative Director (to the present)

President (to the present)

- Jun 2025

- Chairman of the Board of Directors and Representative Director (to the present)

Shinichi Kajiya

President and Representative Director

- Apr 1989

- Entered the Company

- Apr 2017

- General Manager, Information & Telecommunication Materials Div.

- Apr 2019

- Executive Officer

- Apr 2022

- Managing Executive Officer

- Jun 2024

- Senior Managing Executive Officer (to the present)

- Jun 2024

- Director (to the present)

- Jun 2025

- President and Representative Director (to the present)

President (to the present)

Masayuki Inagaki

Representative Director, Executive Vice President

Overseeing Corporate Research & Development Div., Advanced Materials Research Laboratory, Bio & Science Research Laboratory, Corporate Production Management & Engineering Div., Corporate Engineering Center and Optical Circuit Business Development Dept.

- Apr 1982

- Entered the Company

- Jun 2009

- Executive Officer

Plant Manager of Utsunomiya Plant

- Apr 2013

- Managing Executive Officer

- Jun 2015

- Director

- Apr 2017

- Senior Managing Executive Officer

- Apr 2021

- Executive Vice President (to the present)

- Jun 2022

- Representative Director (to the present)

Takashi Kobayashi

Director, Senior Managing Executive Officer

Overseeing High-performance Plastics Segment

- Apr 1987

- Entered the Company

- Sep 2007

- President of Sumitomo Bakelite (Nantong) Co., Ltd.

- Apr 2013

- Executive Officer

- Apr 2017

- Managing Executive Officer

- Jun 2018

- Director (to the present)

- Jan 2021

- Representative Director, Kawasumi Laboratories, Inc. (now SB Kawasumi Laboratories Inc.)

- Apr 2023

- Senior Managing Executive Officer (to the present)

Keisuke Kurachi

Director, Senior Managing Executive Officer

Overseeing Semiconductor Materials Segment

- Apr 1985

- Entered the Company

- Apr 2016

- Executive Officer

Representative Director, Kyushu Sumitomo Bakelite Co., Ltd. (to the present)

- Apr 2018

- Managing Executive Officer

- Apr 2022

- Representative Director, Sumitomo Bakelite (Taiwan) Co., Ltd. (to the present)

- Jun 2022

- Director (to the present)

- Apr 2023

- Senior Managing Executive Officer (to the present)

Toshiya Hirai

Director, Managing Executive Officer

Overseeing Corporate General Affairs Div., Personnel Div., Corporate Planning Dept.,

Sustainability Promotion Dept., IT Promotion Div., Osaka Office and Nagoya Office.

In charge of Corporate Finance & Planning Div., and Global Procurement Div.

- Apr 1986

- Entered Sumitomo Chemical Co., Ltd.

- Jul 2022

- Executive Officer

- Apr 2023

- Managing Executive Officer(to the present)

- Jun 2023

- Director (to the present)

Kazuo Matsuda

Outside Director

- Apr 1971

- Entered The Fuji Bank, Limited (currently Mizuho Bank, Ltd.)

- Apr 2000

- Senior Managing Executive Officer of Fuji Securities Co., Ltd. (currently Mizuho Securities Co., Ltd.)

- Oct 2000

- Managing Executive Officer of Mizuho Securities Co., Ltd.

- Jun 2009

- Director, Representative Executive Vice President of NSK Ltd.

- Jun 2011

- Special Advisor of NSK Ltd.

Outside Corporate Auditor of Daido Metal Co., Ltd. (to the present)

- Jun 2015

- Outside Corporate Auditor of the Company

- Jun 2016

- Outside Director of the Company (to the present)

Etsuko Nagashima

Outside Director

- Oct 1978

- Entered Deloitte Touche Tohmatsu LLC

- Jul 1980

- Entered Tsukeshiba CPA Accounting Office

- Oct 1982

- Certified Public Accountant registration

- Jun 1988

- Established Nagashima CPA Accounting Office, Representative (to the present)

- Apr 2008

- Representative Partner of Veritas Audit Firm

- Jun 2016

- Outside Director (Auditing & Supervisory) of BULL-DOG SAUCE CO., LTD.

Director (Auditing & Supervisory) (to the present)

- Jun 2019

- Outside Corporate Auditor of the Company

- Jun 2021

- Outside Director of the Company (to the present)

Hiroyuki Wakabayashi

Outside Director

- Apr 1979

- Entered DENSO CORPORATION

- Jun 2006

- Executive Director of DENSO CORPORATION

- Jun 2013

- Senior Executive Director, Member of the Board of DENSO CORPORATION

- Jun 2014

- Director, Member of the Board, Senior Executive Director of DENSO CORPORATION

- Jun 2015

- Senior Executive Director of DENSO CORPORATION

- Jun 2016

- Director, Member of the Board, Senior Executive Director of DENSO CORPORATION

- Apr 2017

- Executive Vice President, Member of the Board of DENSO CORPORATION

- Jun 2024

- Outside Director of the Company (to the present)

Yoshikazu Takezaki

Standing Corporate Auditor

- Apr 1985

- Entered the Company

- Jun 2008

- Manager of Human Resources Development Dept.

- Apr 2015

- Executive Officer

- Apr 2021

- Managing Executive Officer

- Jun 2023

- Standing Corporate Auditor (to the present)

Katsushige Aoki

Standing Corporate Auditor

- Apr 1986

- Entered Sumitomo Chemical Co., Ltd.

- Mar 2012

- General Manager, Internal Control and Audit Dept. of Sumitomo Chemical Co., Ltd.

- Jun 2019

- Standing Corporate Auditor of the Company (to the present)

Kazuhiko Yamagishi

Outside Corporate Auditor

- Apr 1984

- Lawyer registration

- Sep 1995

- New York State attorney registration

- Mar 1998

- Partner of Asahi Law Offices (to the present)

- Jun 2015

- Outside Corporate Auditor of New Cosmos Electric Co., Ltd. (to the present)

- Jun 2019

- Outside Corporate Auditor of the Company (to the present)

Noriko Kawate

Outside Corporate Auditor

- Apr 1999

- Entered Tohmatsu & Co. (Now Deloitte Touche Tohmatsu LLC)

- Jul 2001

- Certified Public Accountant registration

- Apr 2003

- Established Kawate CPA Office,

Principal (to the present)

- Nov 2004

- Certified Tax Accountant registration

- Feb 2008

- Established CLEA Consulting Co., Ltd.,

Representative Director (to the present)

- May 2011

- Outside Director of Ichigo Inc. (to the present)

- Nov 2011

- U.S. Certified Public Accountant registration

- Feb 2015

- Partner of Cast Group (currently Cast Global Group) (to the present)

- Jun 2021

- Outside Corporate Auditor of the Company (to the present)

Outside Corporate Auditor of Nichireki Co., Ltd. (to the present)

Executive Officer

Managing Executive Officer

Nobuyuki Sashida Makoto Suzuki Atsushi Tanaka Hisao Nakanishi Takeshi Saino

Executive Officer

Toshihide Kanazawa Yasuhisa Ikeyama Hiromi Oki Hiroshi Nomura Akiko Okubo Takeshi Mori Osamu Ohnishi Tsuyoshi Marumo

Directors and Corporate Auditors Skills Matrix

Our Board of Directors is structured to include Inside Directors who have the knowledge, experience, and ability to fulfill their responsibilities to ensure the sustainable growth of the Company and increase its corporate value over the medium-to-long-term, and to supervise management’s execution of operations. The Board also includes Outside Directors, who can be expected to express their opinions on Company policies and business execution based on their objective viewpoints. The following table sets forth the critical knowledge, experience, and abilities required by the Board of Directors and their relationship to each Director.

| Name Position at the Company |

Knowledge, experience, ability, etc. | |||||||

| Corporate management | Global | Sales and marketing | Manufacturing and production engineering | Research and Development | Sustainability and ESG | DX and information system | Finance and accounting | |

| Kazuhiko Fujiwara Chairman of the Board of Directors and Representative Director |

● | ● | ● | |||||

| Shinichi Kajiya President and Representative Director |

● | ● | ● | |||||

| Masayuki Inagaki Representative Director, Executive Vice President |

● | ● | ● | |||||

| Takashi Kobayashi Director, Senior Managing Executive Officer |

● | ● | ● | |||||

| Keisuke Kurachi Director, Senior Managing Executive Officer |

● | ● | ● | |||||

| Toshiya Hirai Director, Managing Executive Officer |

● | ● | ● | |||||

| Kazuo Matsuda Outside Director |

● | ● | ● | |||||

| Etsuko Nagashima Outside Director |

● | ● | ● | |||||

| Hiroyuki Wakabayashi Outside Director |

● | ● | ● | |||||

- Note:

This table does not cover all of the knowledge, experience, abilities, etc. required of the Company’s Board of Directors.

Key knowledge, experience, abilities, etc. of Drectors are marked with ●.

Reasons for selection of key knowledge, experience, and abilities required by our Board of Directors

| Corporate management | In order to realize our vision of being “‘a company providing dreams for the future’ through creating value with our customers,” the ability to view corporate management as a whole and formulate strategies to enable value creation is necessary. The Company, therefore, determined that the Board requires members with deep insight and experience in corporate management overall. |

| Global |

For the Company, which deploys its business globally, the ability to formulate appropriate strategies

based on an understanding of the cultures and market attributes of each country and region is

necessary. The Company, therefore, determined that the Board requires members with a global

perspective and experience. |

| Sales and marketing | To address customer needs and ensure our advantage in a competitive environment, the ability to understand customer and market trends on a deeper level and formulate appropriate sales strategies is necessary. The Company, therefore, determined that the Board requires members with extensive experience in sales and marketing. |

| Manufacturing and production engineering | As a manufacturer, the efficient and stable provision of high-quality products is the foundation for value creation, and to maintain and reinforce this foundation, the optimization of the manufacturing process and the promotion of technological innovation are necessary. The Company, therefore, determined that the Board requires members with knowledge and experience in manufacturing and production engineering. |

| Research and Development | The source of value creation in manufacturing is innovative technology, and to continue to create such technology, the establishment of a strategic research and development framework that can tap into growth areas is necessary. The Company, therefore, determined that the Board requires members with deep insight into research and development. |

| Sustainability and ESG | To contribute to the achievement of a sustainable society, the creation of environmental and social value by addressing various problems, such as climate change, is necessary. The Company, therefore, determined that the Board requires members with a working knowledge of sustainability, the environment, society, and governance. |

| DX and information system | In order to promote data-driven management, which forms the basis of prompt decision-making, while utilizing digital technology to drive more efficient research and development and manufacturing, and to advance business process reforms, the Company determined that the Board requires members with knowledge and experience in DX and information systems. |

| Finance and accounting | To maximize corporate value, an accurate understanding of the Company’s financial situation, as well as the establishment of a sound financial foundation and the pursuit of capital efficiency are necessary. The Company, therefore, determined that the Board requires members with a deep understanding of financial strategies, including fund procurement and allocation, and accounting. |

The Board of Corporate Auditors intends to maintain the diverse composition of members with appropriate experience and abilities, including a knowledge of finance, accounting, and legal affairs, and to conduct fair, impartial, and efficient auditing activities going forward. The correspondence between key knowledge, experiences, and abilities, etc. which the Board of Corporate Auditors requires and the respective Corporate Auditors are described below.

| Name Position at the Company |

Knowledge, experience, abilities | ||||

| Corporate and organizational management | Finance and accounting | Legal affairs and compliance | Internal control and risk management | Global | |

| Yoshikazu Takezaki Standing Corporate Auditor |

● | ● | ● | ||

| Katsushige Aoki Standing Corporate Auditor |

● | ● | ● | ||

| Kazuhiko Yamagishi Outside Corporate Auditor |

● | ● | ● | ||

| Noriko Kawate Outside Corporate Auditor |

● | ● | ● | ||

- Note: This table does not cover all of the knowledge, experience, abilities, etc.

required of the Company’s Board of Corporate Auditors.

Key knowledge, experience, abilities, etc. of the Corporate Auditors are marked with ●.

Reasons for selection of key knowledge, experience, and abilities required by our Corporate Auditors

| Corporate and organizational management | To conduct effective audits of business activities intended to sustainably enhance the Company’s corporate value and the Directors and Board of Directors who oversee those business activities, it is extremely useful to have knowledge or experience of corporate management, organizational management, or operations that supports such management. |

| Finance and accounting | Sound financial foundations, effective business operations, and appropriate information disclosures are essential for enhancing corporate value, and high-level knowledge and experience in finance and accounting are extremely useful for auditing the appropriateness of these undertakings and auditing the activities of audit firms. |

| Legal affairs and compliance | We conduct diverse business activities globally, and the compliance risks are highly varied, and therefore, knowledge and experience of legal affairs and compliance are extremely useful for effectively auditing management of those risks. |

| Internal control and risk management | Appropriate governance systems, internal control systems, and risk management that also encompasses subsidiaries are essential for sustainable enhancement of corporate value, and knowledge and experience concerning internal control and risk management are extremely useful for effective audits of such systems and management. |

| Global | We conduct business activities globally in highly varied regions, and therefore, a global perspective and experience based on an understanding of the diverse cultures and environments acquired through overseas work and other means are extremely useful for undertaking audit activities. |

Corporate Governance Report

Topics More

- 2026/02/27IRNotice Concerning Changes in Representative Director and Executive Officers(PDF 157KB)

- 2026/02/27IRNotice regarding Cancellation of Own Shares(PDF 286KB)

- 2026/02/04IRBriefing Session on the Acquisition of Part of Kyocera Corporation's Chemical Business on the IR Events page

- 2026/02/02IRSummary of Consolidated Business Results for the Nine Months Ended December 31, 2025

- 2026/01/22IRNotice Concerning Acquisition of Shares of Newly Established Company That Will Succeed Part of Chemical Business of Kyocera Corporation by Absorption-Type Company Split

Inquiry

Inquiry FAQ

FAQ