Basic Approach to Corporate Governance

We have set “Toward a sustainable society through expanding the potential of plastics” as the purpose of our Group with the goal of contributing to value creation for customers and various other stakeholders. For this reason it is important to earn the trust of society and be needed by society, and therefore, we are establishing efficient and effective structures for achieving management that are highly compatible with society and the environment and for addressing risks facing management, including rigorous compliance.

History of strengthening of corporate governance

| 2002 | Appointed first one Outside Director |

| 2004 | For accelerating managerial decision-making and clarifying management responsibility, introduced executive officer system and reduced the number of Directors (from 17 to 8) |

| 2005 | Shortened term of office of Directors (from 2 years to 1 year) |

| 2015 | Increased the number of Outside Director (from 1 to 2) |

| 2016 | For structuring an opinion hearing of Independent Outside about nomination and remuneration of Directors, established the Appointment and Remuneration Advisory Committee |

| Increased the number of Outside Director (from 2 to 3) | |

| Appointed first one female Outside Corporate Auditor | |

| Started analysis and evaluation of effectiveness of the Board of Directors | |

| 2018 | For exchanging information and sharing company view with Outside Officers, established Outside Officers' Meeting |

| 2021 | Appointed first one female Outside Director |

| Appointed three Independent Outside Directors (one-third of Directors) | |

| The authority of the Appointment and Remuneration Advisory Committee is strengthened and reorganized into an Appointment and Remuneration Advisory Committee with a majority of independent Outside Directors. | |

| 2023 | Introduced system of restricted stock to Officers |

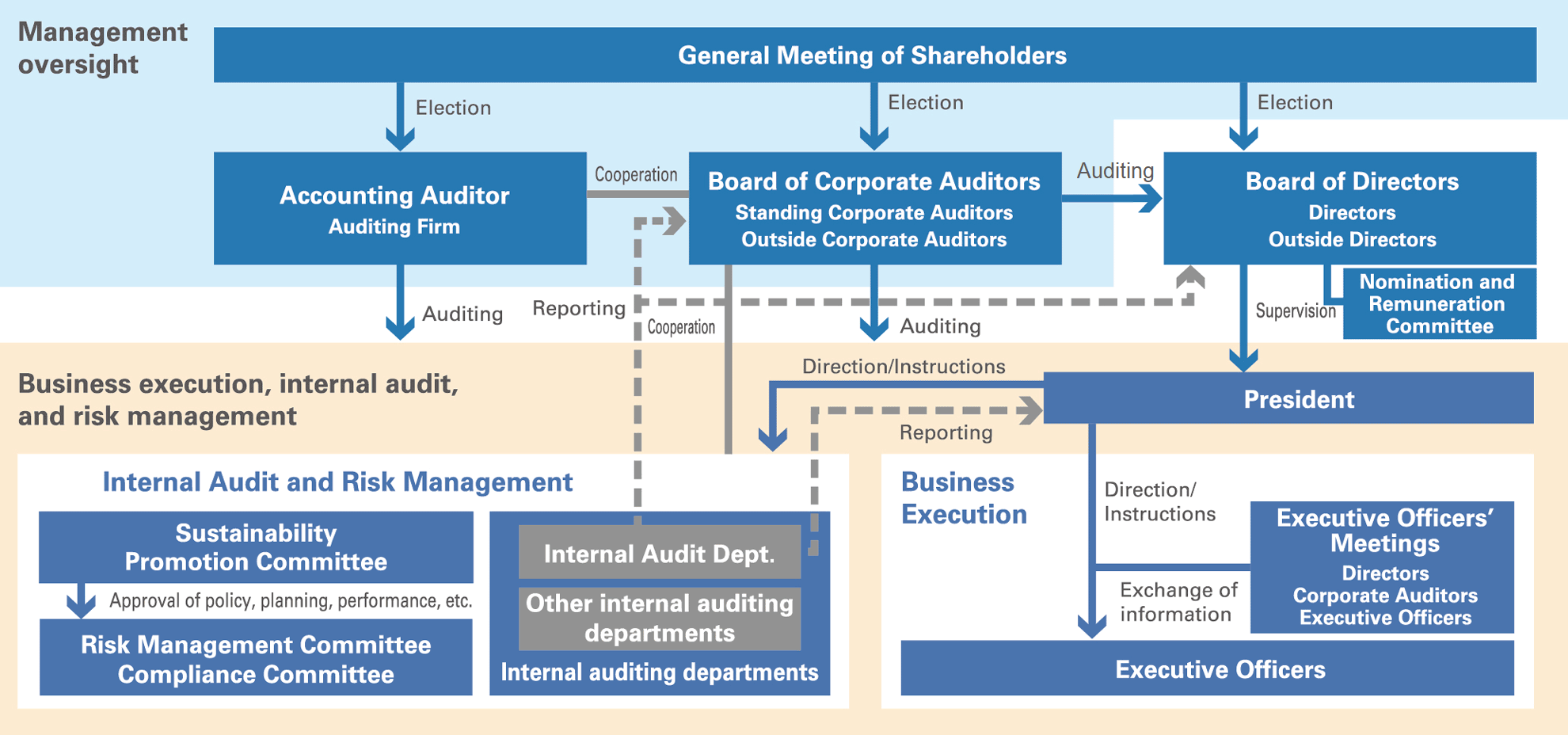

Management System

Board of Directors

We have adopted a company with Corporate Auditors model and have appointed nine Directors (of which three are Outside Directors) and four Corporate Auditors (of which two are Outside Corporate Auditors) as of June 25, 2024. The Board of Directors is chaired by the President, Representative Director.

At the monthly Board of Directors meetings, Directors make decisions on important matters of business, receive reports on monthly business performance and progress updates from each Director, and listen to the opinions and reports from Corporate Auditors, with the chair of the meeting taking care to ensure sufficient discussion takes place. The chair also holds hearings on the opinions of and reports from Corporate Auditors to ensure that thorough discussions are carried out. In the case of conflicts of interest involving any Director, potential conflicts of interest are required to be reported in advance to the Board of Directors to obtain its approval, with reports to be given on the propriety of this after the fact.

In fiscal 2023, 13 meetings were held to resolve matters related to important business executions based on the laws and regulations, articles of incorporation, and rules and regulations of the Board of Directors. It also reported on the performance and overall status of each business segment and reported on discussions by the Sustainability Promotion Committee and other in-house committees as well as reported on and discussed matters related to sustainability promotion related to ESG; risks faced by the Company, their countermeasures, and other risk management; initiatives related to DE&I, analysis of employee engagement survey results, and other human capital initiatives; and improvement of the effectiveness based on the results of the Board of Directors effectiveness evaluation. In addition, several discussions focusing on the formulation of the new Medium-term Business Plan, which started in fiscal 2024, were conducted. The Board also resolved to establish new important material Issues to achieve the vision stipulated in the Medium-term Business Plan: “We aim to be a “company providing dreams for the future” through creating value with our customers.”

Board of Corporate Auditors

The Board of Corporate Auditors consists of two Standing Corporate Auditors and two part-time independent Outside Auditors, and has a diverse composition of individuals with appropriate experience and capabilities, including knowledge of finance, accounting, and legal matters, to provide fair, impartial and efficient auditing activities. In addition, under the direction and orders of the Corporate Auditors, one staff member (attached to the Corporate Auditors), who serves concurrently in the Auditing Office and has expertise in internal auditing, assists the Board of Corporate Auditors and each Corporate Auditor in their activities. The Board of Corporate Auditors resolves, discusses, reports, and determines important items related to auditing based on the laws and regulations, articles of incorporation, and rules and regulations of the Board of Corporate Auditors. The Board of Corporate Auditors meeting is held monthly prior to the Board of Directors meeting and also on an ad hoc basis when necessary. In fiscal 2023, the Board of Corporate Auditors met 19 times for an average of 1 hour 21 minutes.

The Board of Corporate Auditors’ basic policy is to respond flexibly to changes in the environment and conduct audits in a fair, unbiased and transparent manner in order to achieve sound and sustainable growth, create medium- to long-term corporate value, and contribute to the establishment of a high-quality corporate governance system that can meet the trust of society. In addition, it reviewed the previous fiscal year’s audit activities to enhance the effectiveness of audits and discussed the assessment and verification of effectiveness among all Corporate Auditors. As a result of the evaluation and analysis in the previous fiscal year, we confirmed the effectiveness of on-site surveys for each business activity and decided to focus on conducting on-site inspections in fiscal 2023 as we did in fiscal 2022. Furthermore, we formulated an audit plant for the current fiscal year focusing on “confirmation of the status of the Group’s governance and risk management,” “confirmation of the maintenance and operation of the Group’s internal control system,” and “confirmation of the status of the Group’s compliance with laws, article of incorporation, regulations, etc.” as important matters that support the sustainability activities that the Group sets as important material issues. Its overview was reported at the Board of Directors meeting held on June 22, 2023, and audit activities were conducted with the support of the Board of Directors. The Board of Corporate Auditors also engages in the following activities:

- As a general rule, it holds a meeting with the President and Representative Director every quarter to report on the audit activities and exchange opinions about various matters of corporate management.

- The Board of Corporate Auditors holds meetings throughout the year with the Accounting Auditor, KPMG AZSA LLC, to share information and exchange opinions about the annual audit plan, risk evaluation and important audit areas, major audit-related issues, the progress of audits, and other matters as well as receive reports on quarterly reviews and the accounting auditor’s auditor reports. With its effectiveness up to fiscal 2022 confirmed, Standing Corporate Auditors will continue to attend on-site inspections in Japan by the accounting auditor and on-site inspections at four important subsidiaries in China and Europe to deepen cooperation while confirming the validity of the audits by the accounting auditor in a comprehensive manner. In addition, we promptly received reports on administrative actions the accounting auditor received from the Japanese Institute of Certified Public Accountants and other bodies related to the audits for other companies in the past during the current fiscal year and confirmed that the effect on the Company is minimal. Especially for several specific themes related to the evaluation of goodwill of an overseas subsidiary that was presented by the accounting auditor under the “major discussion items in auditing,” we held discussion with the accounting auditor several times according to the progress of the audit, such as during the planning of the audit plan for fiscal 2023, reporting on the results of the quarterly review during the fiscal year, and audit report for the end of the fiscal year. We also attended discussions during on-site inspections of the subsidiary and carefully determined and concluded that there were no differences of opinion.

- We place importance on coordinating with Outside Directors to further enhance the effectiveness of the Board of Directors and the Board of Corporate Auditors. As such, all Corporate Auditors attend the Outside Officers’ Meetings noted below, and exchange opinions and share various management-related information, such as M&A and other important investment projects, important business restructuring, sustainability activities and other agenda items and reports at the Board of Directors meetings, and evaluation of the effectiveness of the Board of Directors. In addition, the Board of Corporate Auditors conducts on-site inspections of business sites and subsidiaries in Japan with Outside Directors who request to attend it as much as possible (visited one site together in fiscal 2023).

- The Standing Corporate Auditors, in addition to receiving reports from the General Manager of the Internal Audit Department, along with the President, on the individual internal audits, participate in internal audit reviews and attend on-site inspections. The Standing Corporate Auditors also provide advice to and exchange opinions with the Internal Audit Department, which conducts the internal audits, through meetings held quarterly, in principle, regarding each stage of the audit process, including the planning, audit approach, reporting of results, and post-audit follow-ups, to ensure their effectiveness. The Board of Corporate Auditors maintains a close cooperative relationship with the Internal Audit Department by having the Standing Corporate Auditors report the status of such exchanges to the Board of Corporate Auditors when appropriate and by holding at least one meeting together with Outside Corporate Auditors per year to exchange information with the Internal Audit Department.

Each Auditor attends important internal conferences including Board of Directors meetings, holds regular meetings with the President and Representative Director of the Company (on a quarterly basis, in principle), and performs other activities according to the Auditing Plan. Items noted during these auditing activities are to be raised as issues or recommendations to the Board of Directors and the Executive Officers’ Meeting as necessary. As part of the above, Standing Corporate Auditors actively create an auditing environment and collect information in the Company, approve important drafts, and receive materials for management meetings to fulfill their role as standing auditors. They also actively participate in Risk Management Committee meetings, Compliance Committee meetings, and other important meetings as well as attend on-site inspections of business sites and subsidiaries selected through the risk approach, accounting audits by the accounting auditor, and internal audits by the Internal Audit Department. In fiscal 2023, in response to the increase of sustainability activities of the Company, Standing Corporate Auditors newly participated in the Sustainability Promotion Committee and actively proposed materialities and the formulation of a human rights policy. In addition to the activities of the Board of Corporate Auditors, Outside Corporate Auditors participate in important meetings such as Executive Officers’ Meetings, business liaison meetings, and budget meetings in addition to the Board of Directors meetings. They also participate in inspections of business sites and subsidiaries as much as possible to make proposals based on their expertise.

Executive Officer Structure / Executive Officers’ Meeting

We have introduced an Executive Officer structure in which Executive Officers appointed by the Board of Directors as the persons responsible for business execution execute business under the direction of the Company President based on the policies determined by the Board of Directors, and have appointed seventeen Executive Officers (including six who serve concurrently as Directors) as of June 25, 2024.

Executive Officers’ Meetings are held once a month and attended by Directors, Executive Officers and Corporate Auditors to convey information on policies and important matters decided by the Board of Directors, to receive reports on business performance and the status of business execution from each Executive Officer, and to review important matters and share information.

With the Executive Officer Structure, the resolution of important operations and execution of operations were separated to increase the effectiveness of the Board of Directors in auditing operational execution, increasing the speed of operational execution and clarifying responsibility. Corporate Auditors oversee the Directors' execution of their roles and audit the Board of Directors to fulfill its role appropriately. As described above, Directors, Corporate Auditors, and Executive Officers fulfill their respective responsibility and roles to govern the Company in a way shareholders and stakeholders can trust.

As of June 25, 2024, all 24 of our officers, who are Directors, Corporate Auditors, and Executive Officers, included 20 men and 4 women, with a female board member ratio of around 17%. All of our officers with the exception of one Corporate Auditor are 50 or older.

Outside Directors / Outside Corporate Auditors

Outside Director Kazuo Matsuda has considerable experience and wide range of insight that he cultivated at a financial institution as well as business companies as a management executive, and we anticipate that he will bring these abilities to bear in providing germane opinions and valuable advice from an objective standpoint. He also serves as a member of the Appointment and Remuneration Advisory Committee.

Outside Director Etsuko Nagashima has an expert viewpoint as a certified public accountant and wide-ranging views related to financial matters and accounting, and we anticipate that she will bring these abilities to bear in providing germane opinions and valuable advice from an objective standpoint. She also serves as a member of the Appointment and Remuneration Advisory Committee.

Outside Director Hiroyuki Wakabayashi has considerable experience and a broad insights that he cultivated as a person in charge of manufacturing at a major manufacturer as well as a management executive in charge of technology in general and IT digital, and we anticipate that he will bring these abilities to bear in providing germane opinions and valuable advice from an objective standpoint. He also serves as a member of the Appointment and Remuneration Advisory Committee.

Outside Corporate Auditor Kazuhiko Yamagishi utilizes his professional perspective as a lawyer and wide-ranging insight into management for auditing our Company.

Outside Corporate Auditor Noriko Kawate utilizes her professional perspective as a Certified Public Accountant and tax accountant and wide-ranging insight into finance, accounting and management for auditing our Company.

We have established the Criteria for Independence of Directors and Corporate Auditors through a resolution of the Board of Directors, and has determined that the aforementioned Outside Directors and Outside Corporate Auditors are independent pursuant to said criteria. In addition, notification of them as independent officers has been submitted as stipulated by the Tokyo Stock Exchange.

We also hold monthly Outside Officers' Meetings consisting of Outside Directors, Outside Corporate Auditors, the Director Overseeing the Corporate General Affairs Division and the Corporate Finance & Planning Division, the Executive Officer in charge of the Corporate General Affairs Division, Standing Corporate Auditors, and members of the Corporate General Affairs Division and the Corporate Finance & Planning Division. At the Outside Officers' Meeting, account settlement overview reports on our Group are shared, introductions to businesses are provided from the Corporate Officers in charge of each segment, and advance explanations of agenda items for meetings of the Board of Directors are provided. This is done in an effort to share information and awareness concerning the Group between Outside Directors and Outside Corporate Auditors.

Structure of Corporate Governance

Appointment and Remuneration Committee

In order to strengthen the independence, objectivity, and accountability of the Board of Directors’ functions concerning the nomination and remuneration, etc. of Directors, the Company has voluntarily established the Appointment and Remuneration Advisory Committee consisting of a majority of Independent Outside Directors (Directors submitted as an Independent Officer to the Tokyo Stock Exchange). The Appointment and Remuneration Advisory Committee was reorganized on June 24, 2021, to reinforce its functions from the Nomination and Remuneration Advisory Committee, which had previously reported to the Board of Directors on matters concerning the nomination of Directors and the determination of remuneration amounts. As of June 25, 2024, the Committee is chaired by President and Representative Director Kazuhiko Fujiwara, with the membership of Independent Outside Directors Kazuo Matsuda, Etsuko Nagashima, and Hiroyuki Wakabayashi.

This Committee holds deliberations regarding Directorship appointments, including assignments to and dismissals from Directorships, elections and dismissals of Representative Directors, as well as plans for successors of the President and Representative Director. It then reports its findings to the Board of Directors based on the results of these deliberations. The committee is delegated based on findings of the Board of Directors to perform decision-making regarding items (including systems and policy) concerning remuneration for Directors.

In fiscal 2023, with regard to the nomination of Directors, the selection of candidates for Directors and setting the skill matrix based on a new director system were discussed as noted above. With regard to the remuneration of Directors, the amounts of individual monthly remuneration for each director and bonuses according to Directorship position were decided. The Committee met a total of four times during fiscal 2023, and all members attended all committee meetings.

Executive Remuneration

To provide an incentive to contribute to the sustained improvement of corporate value of the Company, the remuneration of Directors of the Company shall be based on a remuneration system that is linked to performance and shareholder value. Specifically, remunerations shall comprise “monthly remuneration,” which is fixed remuneration according to position, “bonuses,” which serve as short-term incentives to motivate the Directors to achieve the annual business plans, and “stock compensation,” medium- to long-term incentives to encourage the sharing of value with shareholders.

However, the remuneration of Outside Directors shall comprise exclusively monthly base pay.

Monthly remuneration shall be a fixed cash payment each month throughout the term of office of the Director, and the amount to be paid to the individual Directors shall be determined according to position by comprehensively taking into account various factors including the management environment and economic conditions. The net amount to be paid for bonuses is calculated by multiplying a fixed multiplier against business profit, and the amount paid to each individual is calculated by multiplying a fixed multiplier determined according to the factors like the person's title or their duties. Stock compensation shall comprise restricted stock compensation and restricted stock corresponding to the amount to be paid according to the Director’s position. The transfer restriction period of the restricted stock shall be the period until the date of retirement from the post of Director or Executive Officer of the Company.

The proportion of each type of remuneration to the total amount of individual remuneration, etc. to be paid to the Directors (excluding Outside Directors) of the Company shall be appropriately determined by taking into account various factors such as the position and responsibilities so that it functions as an incentive to contribute to the sustained improvement of corporate value of the Company.

The total amount of bonuses paid to Directors in fiscal 2023 was determined by the Board of Directors and the amounts of individual monthly remuneration, bonuses, and stock compensation for each Director were determined by the Appointment and Remuneration Advisory Committee, which was entrusted based on a resolution at the Board of Directors meeting.

The remuneration of Corporate Auditors consists of base pay (monthly pay). The net amount and the amounts paid to each individual are determined by consultations with the Corporate Auditors within the total amount of remuneration approved by the Shareholders' Meeting.

Remuneration for Executive Officers in fiscal 2023 comprised a total of ¥426 million (monthly base pay of ¥235 million, bonus of ¥162 million, and stock compensation of ¥28 million) for seven Directors (excluding Outside Directors), a total of ¥55 million (monthly base pay of ¥55 million) for three Corporate Auditors (excluding Outside Corporate Auditors), and a total of ¥58 million (monthly base pay of ¥58 million) for five Outside Officers.

Analysis and Evaluation of the Effectiveness of the Board of Directors

The Company evaluates the effectiveness of the Board of Directors each year. The Company enhances the effectiveness of the Board of Directors by executing the PDCA cycle of conducting self-evaluations and aggregation of opinions based on a questionnaire survey of all members of the Board of Directors (Directors and Corporate Auditors), holding discussions and exchanges of opinions at meetings based on the analysis results of the survey, summarizing the evaluation results based on these discussions and setting the issues to be addressed, and at the Board of Directors implementing initiatives to resolve these issues. The results of the analysis and evaluation of the effectiveness of the Board of Directors for fiscal 2022 are summarized below.

1. Evaluation Process and Method

- • The Company confirmed the progress made in the initiatives to improve the issues recognized based on the results of the evaluation of effectiveness of the previous fiscal year at the Outside Officersʼ Meeting held in December 2023, discussed the policy and implementation method of the effectiveness evaluation for fiscal 2023, and then concluded that the method of self-evaluation using questionnaires was valid from the perspective of PDCA cycle execution and would continue to be adopted, as was the case in the previous fiscal year.

- • Based on the results of the Outside Officers’ Meeting above and upon confirming at the Board of Directors meeting held in January 2024 the policy, implementation method, and items in the questionnaire for the effectiveness evaluation of the Board conducted in fiscal 2023, the Company conducted a questionnaire of all Directors and Corporate Auditors in February 2024.

- • The questionnaire covered broad topics of the composition of the Board of Directors, its operation, agenda items, and supply of information as in the previous year and evaluated each item with a four-point scale. Furthermore, a free-answer section was attached to each question to collect respondents’ honest opinions, and a section explaining the intent of the question was added to narrow the focus. To ensure objectiveness and transparency, the questionnaire items were set to reflect the issues recognized in the previous fiscal year and the Company’ s ongoing initiatives in addition to having sought the advice of an external lawyer at the time of formulating the questionnaire.

- • The results of the above questionnaire were anonymized and tabulated, and then opinions on the tabulated results were exchanged at the April 2024 Management Committee meeting (attended by Standing Directors) and the meeting of Outside Directors. The Board of Directors at the meeting held in May 2024 deliberated on the discussions and opinions extended during these meetings and summarized the results of the evaluation, as well as established newly-recognized issues and a policy for making improvements on the newly-recognized issues, as described in the following paragraphs.

2. Overview of the Evaluation Results and the Status of Addressing the Initiatives Raised in the Previous Fiscal Year

As a result of the questionnaire, there were no quantitative or qualitative issues regarding the broad topics of the composition of the Board of Directors, its operation, agenda items, and supply of information, and their effectiveness is ensured. Meanwhile, “promotion of sharing discussions that led to the agenda,” a major item in the agenda items, selected to be addressed in the previous fiscal year was pointed out to be insufficient as described below. There was also an opinion to analyze the balance between matters for resolution and matters to be reported to make clear separations. We confirmed that these items will require further improvement to enhance their effectiveness. The status of initiatives raised in the previous fiscal year and their evaluation results are the following.

- • Initiative 1: Strengthen discussions of themes contributing to the medium- to long-term enhancement of corporate value at the Board of Directors.

(Response) In addition to sustainability, human capital, and other issues related to ESG, we increased the number of items that contribute to increasing corporate value in the mid- to long-term being discussed at the Board of Directors meetings by actively discussing the new Medium-term Business Plan that begins from fiscal 2024. (Evaluation) In response to the above, it was evaluated that there was a significant improvement. Going forward, we confirmed further deepening of the discussion of each theme. - • Initiative 2: Promote the sharing of discussions that led to the agenda

(Response) More active explanation about the discussions on the agenda item at management meetings by the proposing Director as well as feedback of opinions and suggestions raised at the Outside Officers’ Meeting by an Outside Director. (Evaluation) Many Outside Officers continued to point out that sharing of discussions at the management meetings was insufficient and sufficient improvements have not been made. Of note, it was pointed out that the process of matters being discussed by the Board of Directors after management meetings was unclear and that clarification of the discussion process was necessary.

3. Newly-recognized Issues and Policy for Improvement Initiatives

As noted earlier, the evaluation concluded that the effectiveness was mostly ensured but considering that matters related to the “promotion of sharing discussions that led to the agenda” and “balance between matters for resolution and matters to be reported” were pointed out to require improvements, we recognize that there is an issue in sharing the process of discussions leading to the agenda (discussions at management meetings and process and the background behind the resolution and reporting at the Board of Directors meetings). The Company recognized that “clarification of agenda setting process” is a measure to improve these issues and decided to further enhance the effectiveness of the Board by establishing it as a policy going forward.

Internal Control

We have systems in place for ensuring appropriate operations in accordance with our Business Philosophy. In accordance with our Basic Policy on Internal Control Systems (partially amended by resolution of the Board of Directors meeting held on February 28, 2023 to further promote the system based on the sustainability management and initiatives to strengthen governance) drawn up by the Board of Directors, we periodically review the systems and promote various activities to enhance internal control.

With respect to internal control over financial reporting, based on our Basic Rules and Regulations for Internal Control over Financial Reporting, we endeavor to enhance systems for ensuring the reliability of our financial reporting, appropriately operate internal control systems in terms of implementation, assessment, reporting, and correction, and ensure appropriate and timely disclosure of corporate information. The Comprehensive Guidelines for Internal Control in Consolidated Subsidiaries covers the items that subsidiaries are required to address in establishing their internal control systems and in their subsequent ongoing implementation of control activities.

The internal control over our financial reporting as of March 31, 2024 was assessed and deemed to be effective by Internal Auditing Departments. In addition, as a result of the accounting auditor's audit, it was confirmed that the internal control report presents fairly the result of assessments of internal control over financial reporting.

Directors (as of June 25, 2024)

Directors and Corporate Auditors

Kazuhiko Fujiwara

President and Representative Director

- Apr 1980

- Entered the Company

- Jun 2009

- General Manager of S-BIO Business Div.

Executive Officer

- Apr 2013

- Managing Executive Officer

- Jun 2014

- Director

- Apr 2016

- Senior Managing Executive Officer

- Jun 2018

- President and Representative Director (to the present)

President (to the present)

Masayuki Inagaki

Representative Director, Executive Vice President

Overseeing Corporate Research & Development Div., Advanced Materials Research Laboratory, Bio & Science Research Laboratory, Corporate Production Management & Engineering Div. and Optical Circuit Business Development Dept. In charge of Corporate Engineering Center.

- Apr 1982

- Entered the Company

- Jun 2009

- Executive Officer

Plant Manager of Utsunomiya Plant

- Apr 2013

- Managing Executive Officer

- Jun 2015

- Director

- Apr 2017

- Senior Managing Executive Officer

- Apr 2021

- Executive Vice President (to the present)

- Jun 2022

- Representative Director (to the present)

Takashi Kobayashi

Director, Senior Managing Executive Officer

Overseeing Kobe Facility Office, Films & Sheets Research Laboratory, Films & Sheets Div., Medical Products Business Div., S-BIO Business Div. and Amagasaki Plant

- Apr 1987

- Entered the Company

- Sep 2007

- President of Sumitomo Bakelite (Nantong) Co., Ltd.

- Apr 2013

- Executive Officer

- Apr 2017

- Managing Executive Officer

- Jun 2018

- Director (to the present)

- Jan 2021

- Representative Director, Kawasumi Laboratories, Inc. (now SB Kawasumi Laboratories Inc.) (to the present)

- Apr 2023

- Senior Managing Executive Officer (to the present)

Keisuke Kurachi

Director, Senior Managing Executive Officer

Overseeing Semiconductor Materials Segment

- Apr 1985

- Entered the Company

- Apr 2016

- Executive Officer

Representative Director, Kyushu Sumitomo Bakelite Co., Ltd. (to the present)

- Apr 2018

- Managing Executive Officer

- Apr 2022

- Representative Director, Sumitomo Bakelite (Taiwan) Co., Ltd. (to the present)

- Jun 2022

- Director (to the present)

- Apr 2023

- Senior Managing Executive Officer (to the present)

Shinichi Kajiya

Director, Senior Managing Executive Officer

Overseeing High-performance Plastics Segment

- Apr 1989

- Entered the Company

- Apr 2019

- Executive Officer

- Apr 2022

- Managing Executive Officer

- Jun 2024

- Senior Managing Executive Officer (to the present)

- Jun 2024

- Director (to the present)

Toshiya Hirai

Director, Managing Executive Officer

Overseeing Corporate General Affairs Div., Personnel Div., Corporate Planning Dept., Sustainability Promotion Dept., Osaka Office and Nagoya Office. In charge of Corporate Finance & Planning Div., IT Promotion Div., and Global Procurement Div.

- Apr 1986

- Entered Sumitomo Chemical Co., Ltd.

- Jul 2022

- Executive Officer

- Apr 2023

- Managing Executive Officer(to the present)

- Jun 2023

- Director (to the present)

Kazuo Matsuda

Outside Director

- Apr 1971

- Entered The Fuji Bank, Limited (currently Mizuho Bank, Ltd.)

- Apr 2000

- Senior Managing Executive Officer of Fuji Securities Co., Ltd. (currently Mizuho Securities Co., Ltd.)

- Oct 2000

- Managing Executive Officer of Mizuho Securities Co., Ltd.

- Jun 2009

- Director, Representative Executive Vice President of NSK Ltd.

- Jun 2011

- Special Advisor of NSK Ltd.

Outside Corporate Auditor of Daido Metal Co., Ltd. (to the present)

- Jun 2015

- Outside Corporate Auditor of the Company

- Jun 2016

- Outside Director of the Company (to the present)

Etsuko Nagashima

Outside Director

- Oct 1978

- Entered Deloitte Touche Tohmatsu LLC

- Jul 1980

- Entered Tsukeshiba CPA Accounting Office

- Oct 1982

- Certified Public Accountant registration/dd>

- Jun 1988

- Established Nagashima CPA Accounting Office, Representative (to the present)

- Apr 2008

- Representative Partner of Veritas Audit Firm

- Jun 2016

- Outside Director (Auditing & Supervisory) of BULL-DOG SAUCE CO., LTD.

Director (Auditing & Supervisory) (to the present)

- Jun 2019

- Outside Corporate Auditor of the Company

- Jun 2021

- Outside Director of the Company (to the present)

Hiroyuki Wakabayashi

Outside Director

- Apr 1979

- Entered DENSO CORPORATION

- Jun 2006

- Executive Director of DENSO CORPORATION

- Jun 2013

- Senior Executive Director, Member of the Board of DENSO CORPORATION

- Jun 2014

- Director, Member of the Board, Senior Executive Director of DENSO CORPORATION

- Jun 2015

- Senior Executive Director of DENSO CORPORATION

- Jun 2016

- Director, Member of the Board, Senior Executive Director of DENSO CORPORATION

- Apr 2017

- Executive Vice President, Member of the Board of DENSO CORPORATION

- Jun 2024

- Outside Director of the Company (to the present)

Yoshikazu Takezaki

Standing Corporate Auditor

- Apr 1985

- Entered the Company

- Jun 2008

- Manager of Human Resources Development Dept.

- Apr 2015

- Executive Officer

- Apr 2021

- Managing Executive Officer

- Jun 2023

- Standing Corporate Auditor (to the present)

Katsushige Aoki

Standing Corporate Auditor

- Apr 1986

- Entered Sumitomo Chemical Co., Ltd.

- Mar 2012

- General Manager, Internal Control and Audit Dept. of Sumitomo Chemical Co., Ltd.

- Jun 2019

- Standing Corporate Auditor of the Company (to the present)

Kazuhiko Yamagishi

Outside Corporate Auditor

- Apr 1984

- Lawyer registration

- Sep 1995

- New York State attorney registration

- Mar 1998

- Partner of Asahi Law Offices (to the present)

- Jun 2015

- Outside Corporate Auditor of New Cosmos Electric Co., Ltd. (to the present)

- Jun 2019

- Outside Corporate Auditor of the Company (to the present)

Noriko Kawate

Outside Corporate Auditor

- Apr 1999

- Entered Tohmatsu & Co. (Now Deloitte Touche Tohmatsu LLC)

- Jul 2001

- Certified Public Accountant registration

- Apr 2003

- Established Kawate CPA Office,

Principal (to the present)

- Nov 2004

- Certified Tax Accountant registration

- Feb 2008

- Established CLEA Consulting Co., Ltd.,

Representative Director (to the present)

- May 2011

- Outside Director of Ichigo Inc. (to the present)

- Nov 2011

- U.S. Certified Public Accountant registration

- Feb 2015

- Partner of Cast Group (currently Cast Global Group) (to the present)

- Jun 2021

- Outside Corporate Auditor of the Company (to the present)

Outside Corporate Auditor of Nichireki Co., Ltd. (to the present)

Executive Officer

Executive Vice President

Sumitoshi Asakuma

Managing Executive Officer

Nobuyuki Sashida Makoto Suzuki

Executive Officer

Atsushi Tanaka Hisao Nakanishi Toshihide Kanazawa Yasuhisa Ikeyama Hiromi Oki Hiroshi Nomura Akiko Okubo Takeshi Mori

Directors and Corporate Auditors Skills Matrix

Our Board of Directors is structured to include Inside Directors who have the knowledge, experience, and ability to fulfill their responsibilities to ensure the sustainable growth of the Company and increase its corporate value over the medium to long term, and to supervise management’s execution of operations. The Board also includes Outside Directors, who can be expected to express their opinions on company policies and business execution based on their objective viewpoints. The following table sets forth the critical knowledge, experience, and abilities required by the Board of Directors and their relationship to each Director.

| Name Position at the Company |

Knowledge, experience, abilities | |||||||

| Corporate management | Global | Sales and marketing | Manufacturing and production engineering | Research and development | Sustainability and ESG | Digital Transformation and information system | Finance and accounting | |

| Kazuhiko Fujiwara Representative Director President |

● | ● | ● | |||||

| Masayuki Inagaki Representative Director Executive Vice President |

● | ● | ● | |||||

| Takashi Kobayashi Director Senior Managing Executive Officer |

● | ● | ● | |||||

| Keisuke Kurachi Director Senior Managing Executive Officer |

● | ● | ● | |||||

| Shinichi Kajiya Director Senior Managing Executive Officer |

● | ● | ● | |||||

| Toshiya Hirai Director Managing Executive Officer |

● | ● | ● | |||||

| Kazuo Matsuda Outside Director |

● | ● | ● | |||||

| Etsuko Nagashima Outside Director |

● | ● | ● | |||||

| Hiroyuki Wakabayashi Outside Director |

● | ● | ● | |||||

- * This table does not represent all of the knowledge, experience, and abilities required by the Company’s Board of Directors. The key items of knowledge, experience, and abilities of each Director is marked “●”.

The Board of Corporate Auditors intends to maintain the diverse composition of members with appropriate experience and abilities, including a knowledge of finance, accounting, and legal affairs, and to conduct fair, impartial, and efficient auditing activities going forward. The correspondence between key knowledge, experiences and abilities, etc. which the Board of Corporate Auditors requires and the respective Corporate Auditors are described below.

| Name Position at the Company |

Knowledge, experience, abilities | ||||

| Corporate and organization management | Finance and accounting |

Legal affairs and compliance |

Internal control and risk management |

Global | |

| Yoshikazu Takezaki Standing Corporate Auditor |

● | ● | ● | ||

| Katsushige Aoki Standing Corporate Auditor |

● | ● | ● | ||

| Kazuhiko Yamagishi Outside Corporate Auditor |

● | ● | ● | ||

| Noriko Kawate Outside Corporate Auditor |

● | ● | ● | ||

- * This table does not represent all of the knowledge, experience, and abilities required by the Company’s Board of Corporate Auditors. The key items of knowledge, experience, and abilities of each Corporate Auditor is marked “●”.

Corporate Governance Report

- Corporate Governance Report(PDF 651KB) [Last Update: June 28, 2024]

Topics More

- 2025/05/12 IR Notice regarding Disposal of Treasury Stock as Granting of Shares through Employee Shareholding Association

- 2025/05/12 IR Summary of Consolidated Business Results for the Year Ended March 31, 2025

- 2025/04/30 IR Notice Concerning Change in Representative Directors

- 2025/03/21 IR Notice Concerning Revision to Year-End Dividend Forecast (Commemorative Dividend for 70th Anniversary of Founding)

- 2025/02/04 IR Notice Concerning Result of Repurchase of Own Shares Through Off-Auction Own Share Repurchase Trading System (ToSTNeT-3) and Completion of Acquisition of Own Shares

Inquiry

Inquiry FAQ

FAQ