Business Overview by Segment Semiconductor Materials

SEMICONDUCTOR

Providing optimal solutions for the Chinese market and AI-related applications where further growth is forecast

A Review of Fiscal Y2024

We made good progress in the Chinese market in FY2024. Sales of strategic products for mobility increased with

the growth of HVs, resulting in increased revenue and profits compared to the previous fiscal year. Demand for

semiconductor encapsulation materials, our mainstay product, has increased in many sectors in the Chinese

market: PCs, smartphones, automobiles, industrial machinery, and home appliances. However, demand remained

sluggish for consumer products in Taiwan and in-vehicle semiconductors in Southeast Asia.

In the mobility

area, although EV demand fell in Europe and the US, increased demand for HVs and new orders in China meant

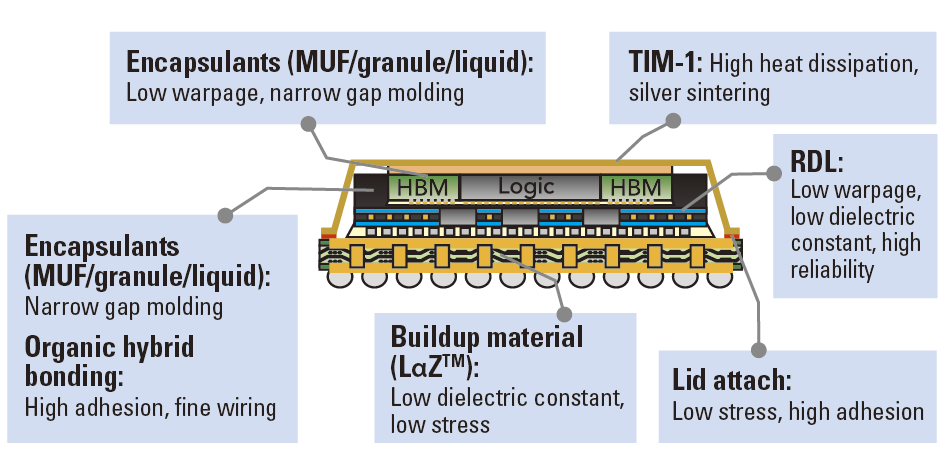

that sales were higher than the previous year. In the advanced semiconductor sector, molded underfill (MUF)

and granule materials are increasingly being adopted for AI semiconductors (edge AI) used in PCs and

smartphones.

We saw an increase in orders of photosensitive materials for new

applications in power semiconductors, with growing adoption in redistribution

applications for advanced semiconductors. Although demand for

bonding paste was sluggish in Taiwan, new orders increased in China.

We are also getting more inquiries about new applications of bonding

paste as a thermal interface material (TIM), leveraging its heat dissipation

properties. Sales of our LZTM substrate materials increased for use

in power semiconductors for smartphones and AI.

Initiatives in FY2025

Sales are predicted to increase in FY2025 with the shift toward in-house production of semiconductors in China. We will utilize our state-of-the-art plant in Suzhou, completed last fiscal year, to respond to growing demand in China. In the areas of AI, power electronics, and mobility, which we have identified as enhanced areas, we will engage in ongoing dialogue with customers, introducing our new materials and leveraging our open laboratories and comprehensive proposals through One Sumibe to provide optimal solutions. We are also strengthening external collaboration, such as the Co-creation Research Center we have established with Tohoku University, to accelerate development of new technologies.

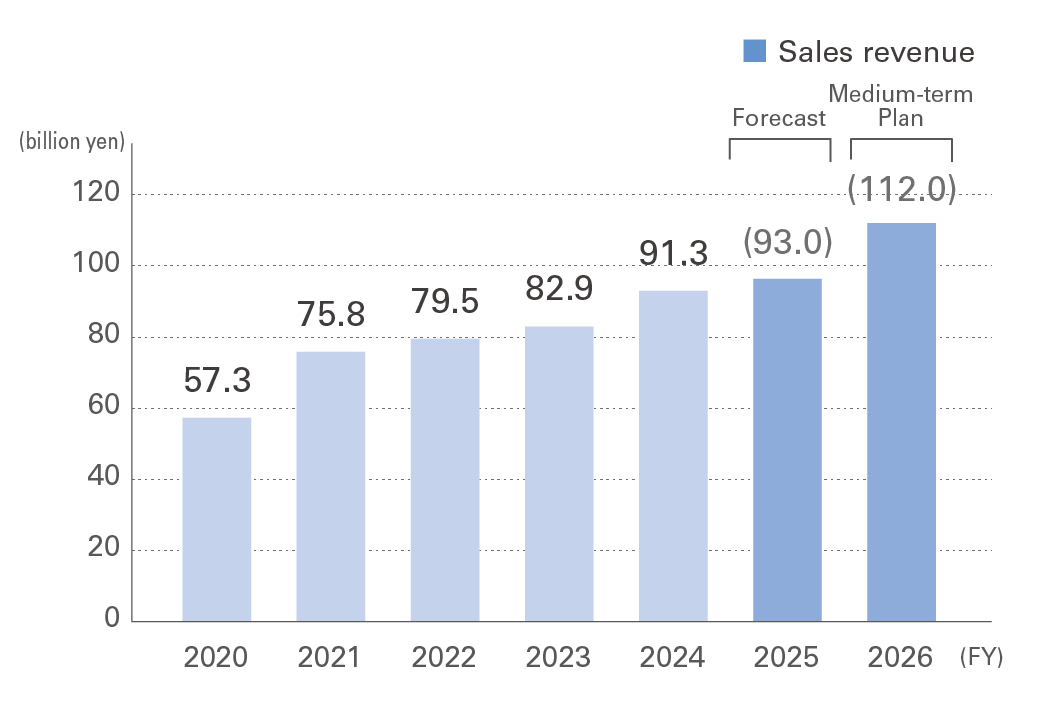

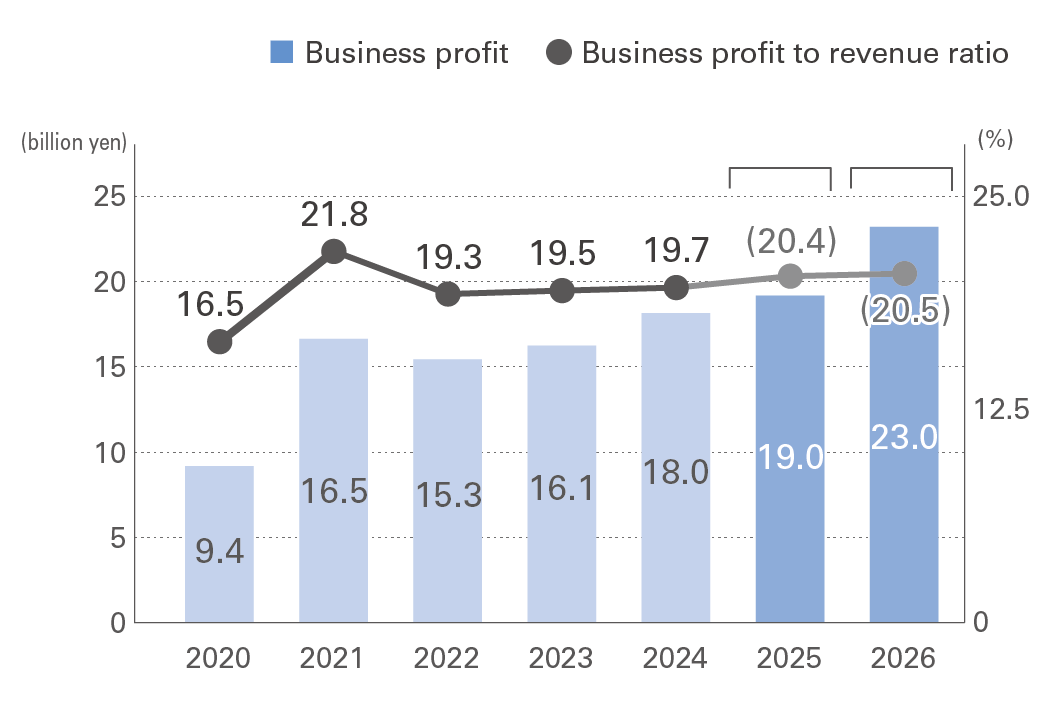

Business Performance (actual results, forecast, Medium-term Business Plan)

FY2024 Business Performance for the Segment

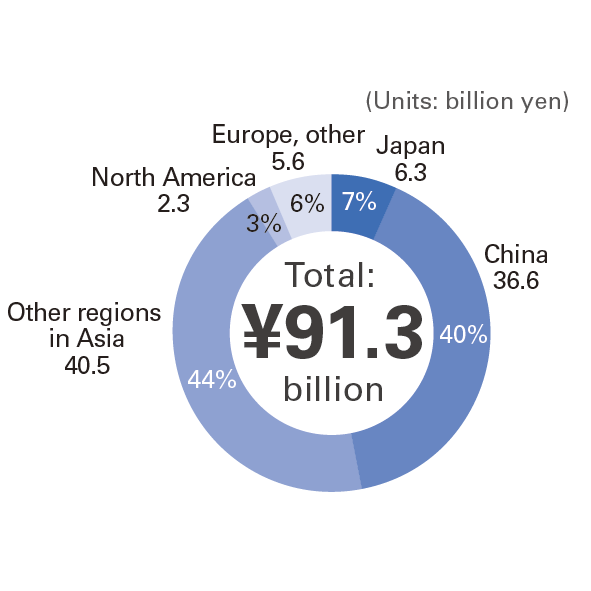

Sales Revenue by Region

Priority SDGs

Business Characteristics/Strengths

- We hold top share of the global semiconductor encapsulation materials market and a competitive edge in the 3+1 strategic products for mobility

- Business framework that integrates production, sales, and research worldwide to enhance management efficiency

- Advanced technical capabilities and relationships of trust built with stakeholders worldwide

- Ability to make product proposals in the form of sets using back-end process materials such as semiconductor encapsulation materials and bonding paste

- Global expansion of open labs enables close one-on-one communication with customers and accelerates research and development

- Ability to propose solutions in a cross-business manner through One Sumibe Activities

Opportunities and Risks

Opportunities

- Market expansion due to a shift toward in-house production of semiconductors in China

- Widespread use of AI semiconductors and other advanced semiconductors

- Growing need for high-performance materials for power electronics, due to increasing demand for AI semiconductors and data centers

- Expansion of strategic products for mobility to new applications such as robotics and industrial applications

Risks

- Intensified competition for mainstay products

- Economic downturn due to changes in tariff policies by the US and other countries

- Stagnation of the xEV market

- Prolonged stagnation in demand in Southeast Asian markets

FY2025 Business Strategy and Enhanced Areas

1. Expand sales in the Chinese market

Utilize the latest facilities at the Suzhou plant, completed in FY2024, to capture new demand as quickly as possible

2. Develop new materials for AI semiconductors

Expand sales of MUF, granule materials, and RDL* materials for edge AI

* RDL: Redistribution layer

Strengthen development of materials for 2.5/3D packaging for AI

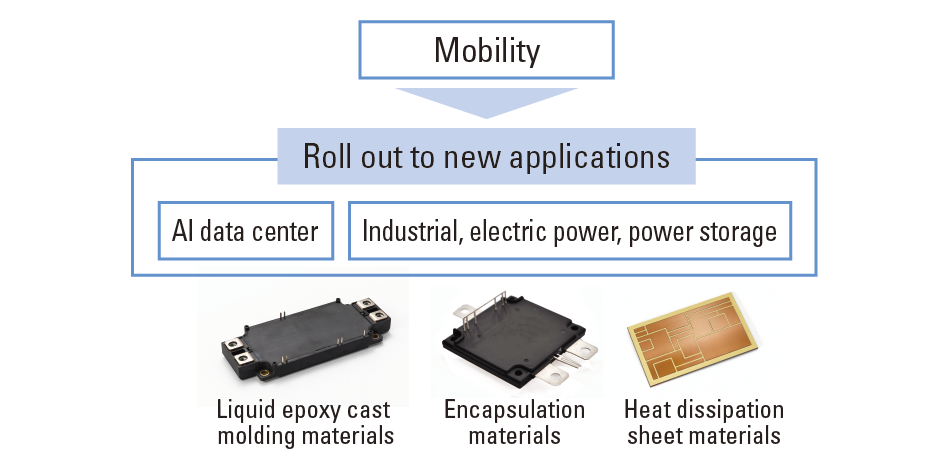

3. Develop materials for power electronics

Create new business opportunities by proposing optimal structures tailored to various applications, from mobility applications where we already have a good track record, to rapidly growing applications like AI data centers and electrical power infrastructure

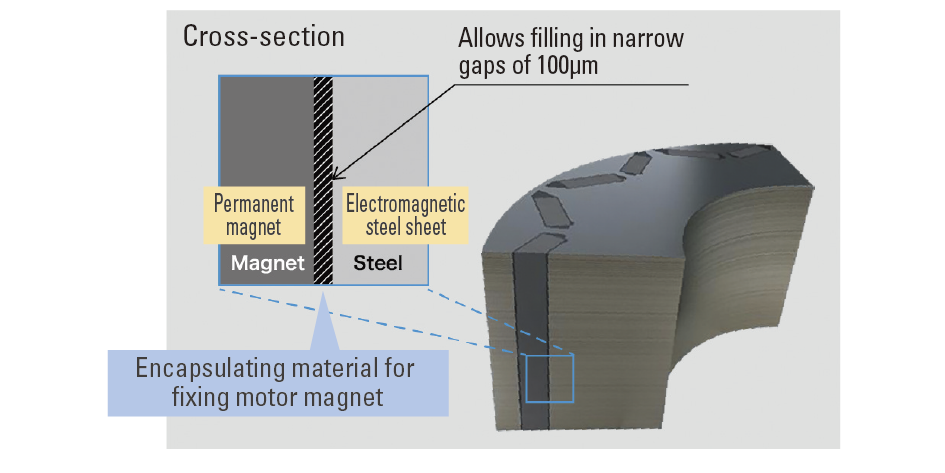

4. New product development of strategic products for mobility

Expand the use of encapsulating materials for stators to new applications, e.g. robotics

Improve performance of fixing motor magnets

Application of direct molding materials in injection molding for ECU, TCU, and sensors