Business Overview by Segment Quality of Life Products

QUALITY OF LIFE

High value-added product lines to accelerate growth looking to the next generation

(Industrial Functional Materials, Waterproof Sheet Products)

A Review of Fiscal Y2024

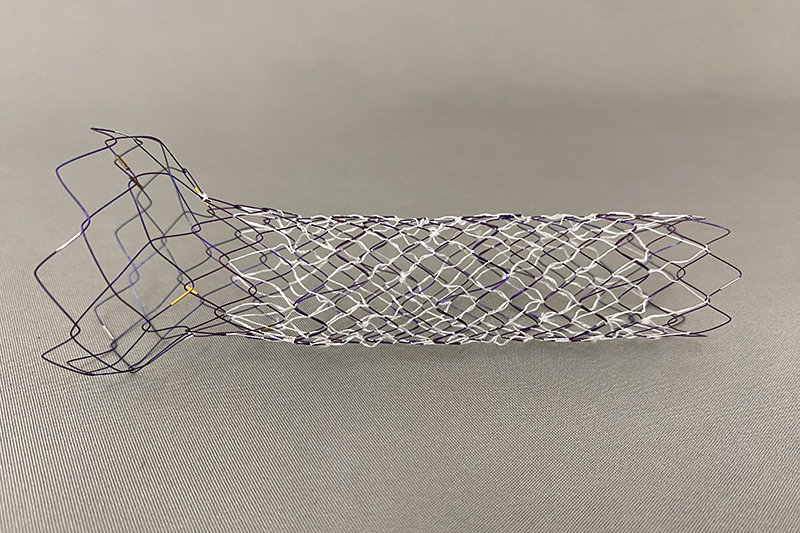

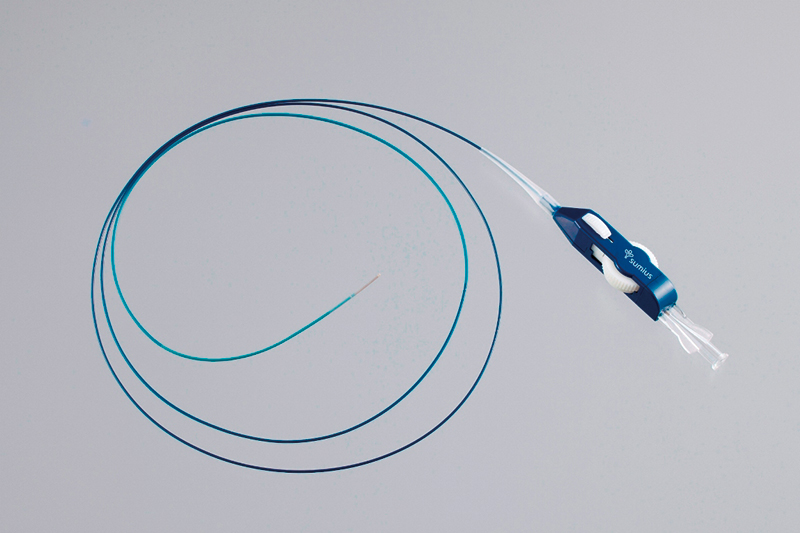

In healthcare, focusing on minimally invasive medical devices, we enhanced our lineup of endovascular and

gastrointestinal endoscopic treatment devices in FY2024. Sales of endovascular devices increased in North

America. High quality blood container bags were well received in Asia and our market share increased.

For

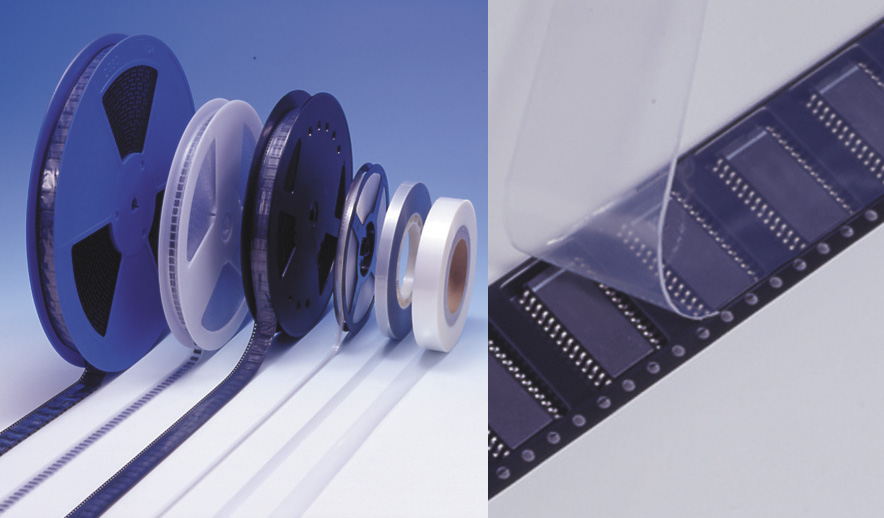

films and sheets, as well as strong sales of PTP pharmaceutical packaging and packaging films for food,

demand recovered in the Chinese and Asian markets for cover tape used to transport electronic components.

The results of our sales promotion activities also contributed to significantly higher sales compared to the

previous fiscal year.

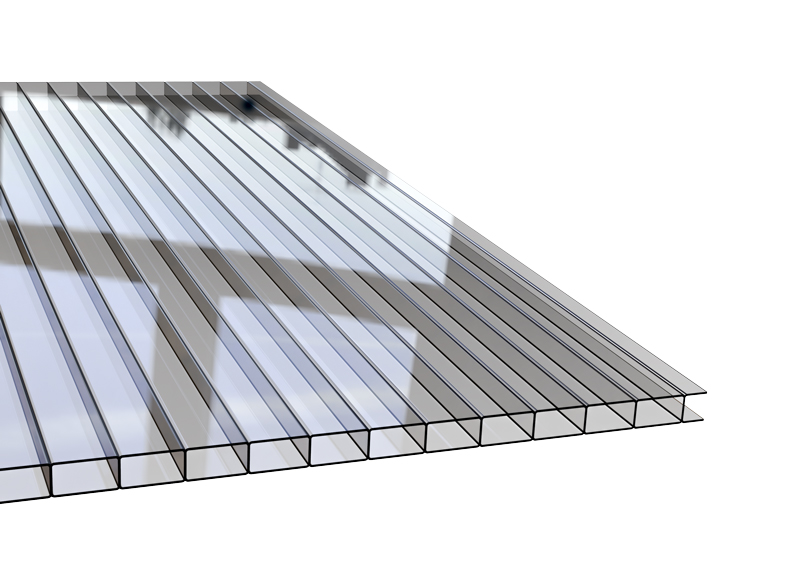

In industrial functional materials, we saw an increase in sales of sheet materials

for architectural & industrial use. We successfully promoted sales of high value-added products such as

optical products for eyewear and head-up displays (HUD) and flame retardant film & sheet for electrical

insulation for vehicles. We recorded our highest ever sales revenue for waterproof sheets for residential

use, and profitability also improved due to more efficient construction.

Initiatives in FY2025

In healthcare, we will expand sales of our enhanced lineup of minimally invasive medical devices and proceed with structural reforms. We will also accelerate our project activities to expand the market for MPS* devices. For films and sheets, we will promote monomaterial PTP for pharmaceutical packaging in Europe. Also, in addition to cover tape, we aim to expand sales of dicing tape for advanced semiconductors. In industrial functional materials, we will work on integrating the polycarbonate business to be acquired from AGC Inc. to enhance competitiveness. In the waterproof sheet products business, we will provide highly durable waterproof systems to add value through longer product life, contributing to the widespread construction of high-quality housing.

* MPS: Microphysiological system

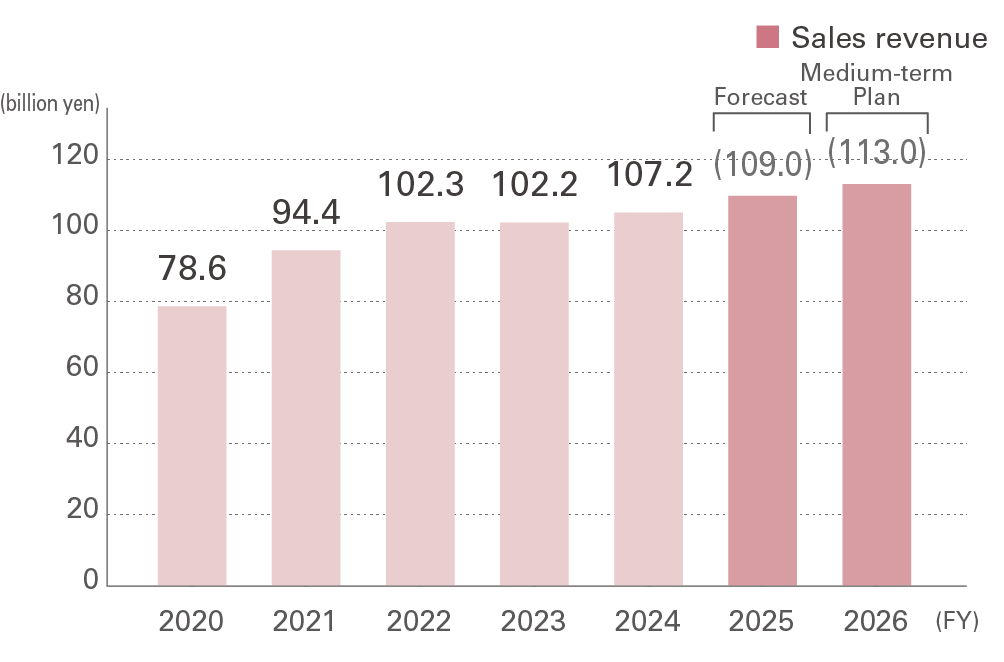

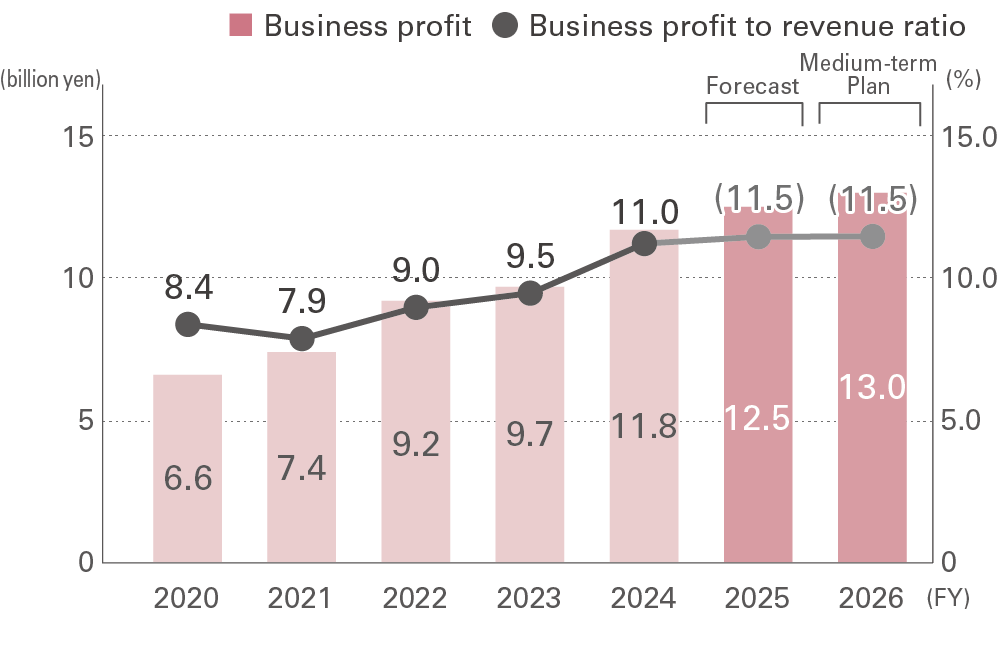

Business Performance (actual results, forecast, Medium-term Business Plan)

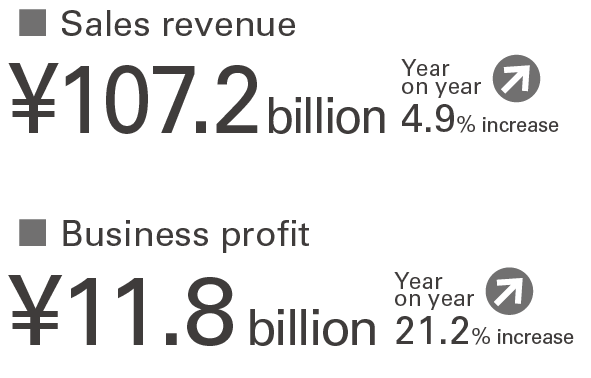

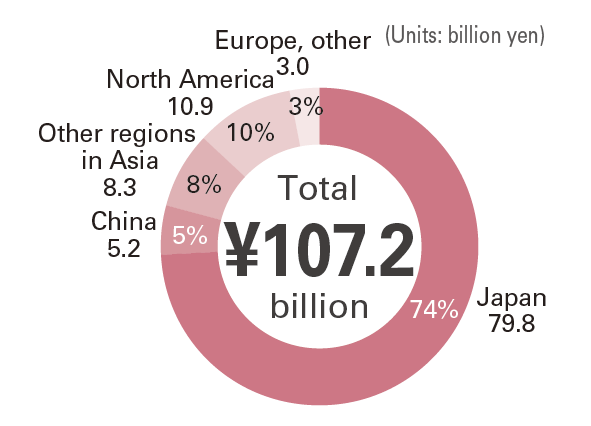

FY2024 Business Performance for the Segment

Sales Revenue by Region

Priority SDGs

Business Characteristics/Strengths

-

Healthcare

Capabilities for developing medical equipment in the field of minimally invasive treatment

Development of drug discovery support, regenerative medicine, and diagnostic reagents utilizing polymer design, microfabrication, and assembly technologies

-

Films and Sheets

High market share in each niche market, ability to respond to customer needs, and efficiency in sales and manufacturing through digital transformation

-

Industrial Functional Materials

High value-added products such as optical products using polarization and optical control technology and flame retardant film & sheet for electrical insulation with top-level electrical characteristics

-

Waterproof Sheet Products

High market share in waterproof sheets for residential use, plus development of high value-added anchor products for solar panel installation

-

Ability to propose solutions in a cross-business manner through "One Sumibe Activities"

Opportunities and Risks

Opportunities

- Advances in medical care and evolution of minimally invasive treatment, market expansion in the regenerative medicine sector, and growing need for MPS

- Requirements for films and sheets in response to evolution of advanced semiconductors, growing need for environmentally friendly materials, and increasing awareness of food loss

- Growing market for optical products such as head-up displays and flame retardant film & sheet for electrical insulation increasingly used in electric vehicles

- Rapid increase in demand for renovations of housing built over 20 years ago

Risks

- Declining prices for healthcare products, decreasing surgical operations, and prolonged medical equipment regulatory approvals

- Opposition to plastic packaging products and intensified competition for mainstay products in films and sheets

- Stagnation in the construction and housing market in Japan

- Rising prices of raw materials, logistics, and outsourcing costs

FY2025 Business Strategy and Enhanced Areas

01. Healthcare

(1) Enhance lineup of minimally invasive medical devices

Gastrointestinal stents: Expand lineup to

include biliary, esophageal, duodenal, and colonic stents

Vascular microcatheters: Start expanding sales

to brain regions

(2) Liblia™ Trypsin in-vitro diagnostic agent

The first diagnostic drug for pancreatitis developed in-house to be commercialized

(3) Strengthen development of MPS devices

Accelerate development by forming a new project

02. Films and Sheets

(1)Pharmaceutical packaging: Start evaluation of monomaterial in the European market

(2)Food packaging: Expand adoption of skin packaging for beef and pork products

(3)Electronic components/semiconductors: Develop new cover tape and dicing tape products

03. Industrial Functional Materials/Waterproof Sheet Products

(1)Optical products and flame retardant film & sheet for electrical insulation for automotive

applications:

Increase competitive edge in the mobility area by technical synergy between new products and business

acquired from AGC Inc.

(2)Resin sheets for construction and industrial use:

Actively develop strong hollow polycarbonate TWINCARBO™ for use in data centers

(3)Waterproof sheet products:

Expand sales of high value-added products such as highly durable

waterproof sheets and solar anchors